SunTrust 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

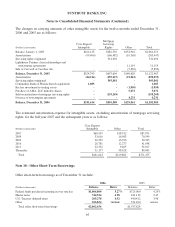

Notes to Consolidated Financial Statements (Continued)

of December 31, 2006. As a result, SunTrust recorded its net funded position related to its retirement

benefit plans, supplemental retirement benefits plan and other postretirement benefits on the

Consolidated Balance Sheets with an offsetting impact, net of tax, to accumulated other comprehensive

income. The impact from the adoption of this standard, net of tax, is a reduction to accumulated other

comprehensive income of $385 million, which was primarily related to unrecognized actuarial losses.

In September 2006, the SEC staff issued Staff Accounting Bulletin (“SAB”) No. 108 to address the

diversity in practice in quantifying financial statement misstatements and the potential impact under

current practice for the accumulation of improper amounts on the balance sheet. In SAB No. 108, the

SEC establishes a “dual approach” for quantifying financial statement errors by requiring evaluation of

the effect on both the current income statement, including reversing the effect of prior year

misstatements, as well as an evaluation of the effect on the period end balance sheet. SAB No. 108 is

effective for the year ended December 31, 2006. SAB No. 108 allows public companies to record the

cumulative effect of initially applying the “dual approach” in the first year by recording the necessary

correcting adjustments to the carrying values of assets and liabilities as of the beginning of 2006 with

the offsetting adjustment recorded to the opening balance of retained earnings. Additionally, the use of

the “cumulative effect” transition method requires detailed disclosure of the nature and amount of each

individual error being corrected through the cumulative adjustment and how and when it arose. The

Company adopted the provisions of SAB No. 108 as of December 31, 2006. The adoption of this

standard did not impact the Company’s financial position or results of operations.

In July 2006, the FASB issued FIN 48, “Accounting for Uncertainty in Income Taxes,” an interpretation

of FAS 109 “Accounting for Income Taxes.” FIN 48 provides a single model to address accounting for

uncertainty in tax positions by prescribing a minimum recognition threshold a tax position is required to

meet before being recognized in the financial statements. FIN 48 also provides guidance on

derecognition, measurement, classification, interest and penalties, accounting in interim periods,

disclosure and transition. FIN 48 is effective for fiscal years beginning after December 15, 2006 and the

cumulative effect of adopting FIN 48 is to be recorded in equity. The Company adopted FIN 48

effective January 1, 2007. While the Company continues to refine the actual financial statement impact

resulting from its adoption of FIN 48, it is estimated that the cumulative effect adjustment will result in

an increase to tax reserves of $40 million to $60 million, with offsetting adjustments to equity and

goodwill. Additionally, in connection with its adoption of FIN 48, the Company elected to classify

interest and penalties related to unrecognized tax positions as components of income tax expense.

In July 2006, the FASB issued FSP No. FAS 13-2, “Accounting for a Change or Projected Change in the

Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction.” The

Internal Revenue Service (“IRS”) has challenged companies on the timing and amount of tax deductions

generated by certain leveraged lease transactions, commonly referred to as Lease-In, Lease-Out

transactions (“LILOs”) and Sale-In, Lease-Out transactions (“SILOs”). As a result, some companies

have settled with the IRS, resulting in a change to the estimated timing of cash flows and income on

these types of leases. The Company believes that its tax treatment of certain investments in LILO and

SILO leveraged lease transactions is appropriate based on its interpretation of the tax regulations and

legal precedents; however, a court or other judicial authority could disagree. FSP No. FAS 13-2

indicates that a change in the timing or projected timing of the realization of tax benefits on a leveraged

lease transaction requires the lessor to recalculate that lease. The Company adopted the FSP effective

January 1, 2007. The Company is continuing to refine the actual financial statement impact resulting

from its adoption of FSP No. FAS 13-2, but the one-time after-tax charge to beginning retained earnings

86