SunTrust 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FOURTH QUARTER 2006 RESULTS

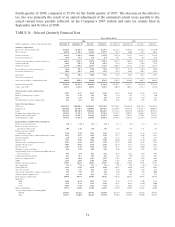

SunTrust reported net income available to common shareholders of $498.6 million for the fourth quarter

of 2006, a decrease of $19.9 million, or 3.8%, compared to the same period of the prior year. Diluted

earnings per average common share were $1.39 and $1.43 for the fourth quarter of 2006 and 2005,

respectively. The fourth quarter of 2006 results included a $7.2 million after-tax loss on extinguishment

of debt and $7.7 million preferred stock dividend related to the Company’s capital restructuring

initiatives, while the fourth quarter of 2005 included $4.1 million of after-tax merger expense related to

the Company’s acquisition of NCF on October 1, 2004. These results have been revised from the

earnings results the Company reported in its January 19, 2007 earnings release in which the Company

reported net income available to common shareholders of $523.6 million, or $1.46 per diluted common

share for the fourth quarter ended December 31, 2006. The reduction in earnings relates to a $40 million

increase in the provision for loan losses associated with the previously disclosed large commercial

credit. See pages 17 and 18 for further details.

Fully taxable-equivalent net interest income was $1,185.2 million for the fourth quarter of 2006, a

decrease of $21.9 million, or 1.8%, from the fourth quarter of 2005. The decline was mainly the result of

the flat to inverted yield curve that has persisted throughout 2006, as well as the continued shift in

deposit mix away from lower-cost deposit products to certificates of deposit. Average loans increased

$7.5 billion, or 6.6%, while average loans held for sale were relatively flat compared to the fourth

quarter of 2005. The net interest margin decreased 18 basis points from the fourth quarter of 2005 to the

fourth quarter of 2006, primarily due to higher short-term borrowing costs and tighter spreads resulting

from the continued flat to inverted yield curve. An overall decline in lower cost deposits, as well as a

shift in deposit mix to higher cost certificate of deposits also contributed to the decline.

Provision for loan losses was $115.8 million in the fourth quarter of 2006, an increase of $67.7 million

from the fourth quarter of 2005. The provision for loan losses was $42.8 million less than net charge-

offs for the fourth quarter of 2006, resulting in a corresponding decrease to the ALLL in the fourth

quarter of 2006. This decrease was primarily due to the charge-off in the fourth quarter of the large

commercial loan that was placed on nonaccrual in the third quarter of 2006 resulting in a reduction in

the specific reserve related to this loan.

Total noninterest income was $882.6 million for the fourth quarter of 2006, an increase of $84.7 million,

or 10.6%, from the fourth quarter of 2005. The increase was driven by higher net securities gains and

higher income from structured transactions. The increase in net securities gains was a result of gains

realized on equity positions sold by the Company in the fourth quarter of 2006 partially offset by a

$24.3 million loss incurred in the fourth quarter of 2006 as a result of restructuring the bond portfolio.

Additionally, growth in retail investment services income, other charges and fees, investment banking

income, card fees and mortgage production related income was offset by declines in service charges on

deposits, trust and investment management income, trading account profits and commissions, and

mortgage servicing related income.

Total noninterest expense was $1,233.8 million for the fourth quarter of 2006, an increase of $26.9

million, or 2.2%, from the fourth quarter of 2005. The increase was primarily attributed to increased

personnel expense, higher outside processing and software, the loss on extinguishment of debt and

divestiture related expenses associated with several Affordable Housing properties designated for sale in

the fourth quarter of 2006. These increases were offset by lower amortization of intangible assets and

marketing and customer development, as well as the absence of merger expense in the fourth quarter of

2006 compared to $6.5 million incurred during the fourth quarter of 2005.

The provision for income taxes was $188.0 million for the fourth quarter of 2006 compared to $211.4

million for the fourth quarter of 2005. The provision represents an effective tax rate of 27.1% for the

50