SunTrust 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

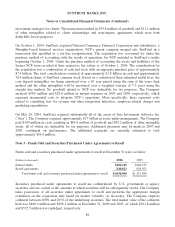

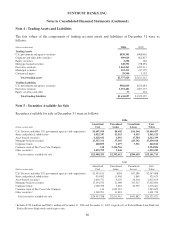

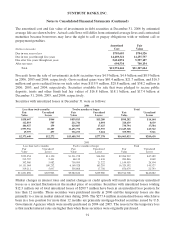

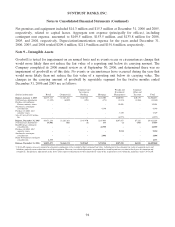

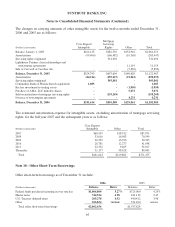

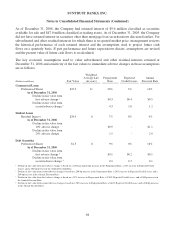

Notes to Consolidated Financial Statements (Continued)

purposes. As of December 31, 2006, AMA Holdings owned 913 member interests of AMA, LLC, and

315 member interests of AMA, LLC were owned by employees. There are 88 employee interests that

may be called by AMA Holdings at its discretion, or put to AMA Holdings by the holders of the

member interest, in accordance with the member agreement. The remaining 227 employee-owned

interests may be subject to certain vesting requirements and may be put or called at certain dates in the

future, in accordance with the member agreement.

On April 4, 2006, SunTrust paid $1.3 million in cash to the former owners of Prime Performance, Inc., a

company acquired by National Commerce Financial Corporation (“NCF”) in March 2004. Payment of

the contingent consideration was made pursuant to the original purchase agreement between NCF and

the former owners of Prime Performance and was considered a tax-deductible adjustment to goodwill.

On March 31, 2006, SunTrust sold its 49% interest in First Market Bank, FSB (“First Market”). The sale

of the Company’s approximately $79 million net investment resulted in a gain of $3.6 million which

was recorded in other income in the Consolidated Statements of Income.

On March 30, 2006, SunTrust issued $15.0 million of common stock, or 202,866 shares, and $7.5

million in cash as contingent additional merger consideration to the former owners of BancMortgage

Financial Corporation, a company acquired by NCF in 2002. NCF and its subsidiaries were purchased

by SunTrust in 2004. Payment of the contingent consideration was made pursuant to the original

purchase agreement between NCF and BancMortgage and was considered an adjustment to goodwill.

On March 17, 2006, SunTrust acquired 11 Florida Wal-Mart banking branches from Community Bank

of Florida (“CBF”), based in Homestead, Florida. The Company acquired approximately $5.1 million in

assets and $56.4 million in deposits and related liabilities. The transaction resulted in $1.1 million of

other intangible assets which were deductible for tax purposes.

On March 10, 2006, SunTrust paid $3.9 million to the former owners of SunAmerica Mortgage

(“SunAmerica”) that was contingent on the performance of SunAmerica. This resulted in $3.9 million of

goodwill that was deductible for tax purposes. On March 9, 2005, the Company paid $4.3 million to the

former owners of SunAmerica that was contingent on the performance of SunAmerica. This resulted in

$4.3 million of goodwill that was deductible for tax purposes. In 2003, SunTrust completed the

acquisition of SunAmerica, one of the top mortgage lenders in Metro Atlanta.

On December 31, 2005, SunTrust sold its 100% interest in Carswell of Carolina, Inc., a full service

insurance agency offering comprehensive insurance services to its clients, for cash totaling $10.9

million.

On March 31, 2005, SunTrust sold substantially all of the factoring assets of its factoring division,

Receivables Capital Management (“RCM”), to an affiliate of CIT Group, Inc. The sale of approximately

$238 million in net assets resulted in a gain of $30.0 million. This gain was partially offset by $6.6

million of expenses primarily related to the severance of RCM employees and the write-off of obsolete

RCM financial systems and equipment. The net gain of $23.4 million was recorded in the Consolidated

Statements of Income as a component of noninterest income.

On January 27, 2005, AMA Holdings purchased the remaining 20% minority interest of Lighthouse

Partners, LLC (“LHP”), a nonregistered limited liability company established to provide alternative

88