SunTrust 2006 Annual Report Download - page 72

Download and view the complete annual report

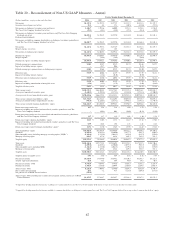

Please find page 72 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Provision for loan losses, which represents net charge-offs for the lines of business, decreased $1.7

million, or 29.7%.

Total noninterest income decreased $67.5 million, or 80.2%, mainly due to an increase in net securities

losses of $44.8 million related to the portfolio restructuring in 2006 and a $14.0 million decrease in

derivative income on economic hedges.

Total noninterest expense decreased $55.5 million, or 63.1%, mainly due to a reduction in merger

expense.

EARNINGS AND BALANCE SHEET ANALYSIS 2005 VS. 2004

Consolidated Overview

Net income totaled $2.0 billion or $5.47 per diluted share for 2005, up 26.3% and 5.4%, respectively,

from 2004. The following are some of the key drivers of the Company’s 2005 financial performance as

compared to 2004:

•Total revenue-FTE increased $1.5 billion, or 23.0%, compared to 2004. The acquisition of NCF,

successful implementation of sales initiatives and intense sales focus drove increases in both net

interest income and noninterest income.

•Net interest income-FTE increased $910.9 million, or 24.3%, and the net interest margin remained

stable at 3.17% for 2005. The increase in net interest income was driven by strong loan and deposit

growth driven by the acquisition of NCF and higher home equity, residential real estate, and middle

market commercial loan volumes.

•The average earning asset yield increased 85 basis points compared to 2004 while the average

interest bearing liability cost increased 101 basis points. This reduction in interest rate spread was

primarily due to increases in short term funding rates throughout 2005.

•Noninterest income improved $550.6 million, or 21.1%, compared to 2004. The increase was driven

by the acquisition of NCF, higher transaction volumes, record mortgage production, and a $23.4

million gain on the sale of Receivables Capital Management.

•Noninterest expense increased $793.7 million, or 20.4%, compared to 2004. The increase was driven

by the acquisition of NCF including a $70.2 million increase in merger expense to integrate the

operations of NCF and consisted primarily of consulting fees for systems and other integration

initiatives, employee-related charges and marketing expenditures. Additionally impacting noninterest

expense was higher personnel costs due to increased headcount, normal merit raises, and increased

incentive costs associated with higher business volumes.

•Credit quality continued to improve throughout 2005. Nonperforming assets declined $76.5 million,

or 18.6%, compared to December 31, 2004 and net charge-offs as a percentage of average loans

declined five basis points to 0.18% compared to 2004.

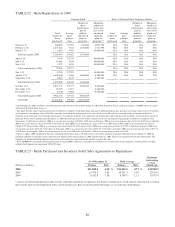

Business Segments

The following analysis details the operating results for each line of business for the years ended

December 31, 2005 and 2004. These periods have been restated to conform to the 2006 presentation.

Retail

Retail’s net income for the twelve months ended December 31, 2005 was $645.3 million, an increase of

$169.4 million, or 35.6%, compared to the same period in 2004. This increase was primarily attributable

to the NCF acquisition, higher net interest income and higher noninterest income partially offset by

higher noninterest expense.

59