SunTrust 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

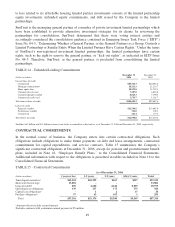

to lend to a customer who has complied with predetermined contractual obligations. The Company also

had $13.0 billion in letters of credit as of December 31, 2006, most of which are standby letters of credit

that provide that SunTrust Bank fund if certain future events occur. Of this, approximately $6.3 billion

support variable-rate demand obligations (“VRDOs”) remarketed by SunTrust and other agents. VRDOs

are municipal securities which are remarketed by the agent on a regular basis, usually weekly. In the

event that the securities are unable to be remarketed, SunTrust Bank would fund under the letters of

credit.

Certain provisions of long-term debt agreements and the lines of credit prevent the Company from

creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further,

there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, and

minimum shareholders’ equity ratios. As of December 31, 2006, the Company was in compliance with

all covenants and provisions of these debt agreements.

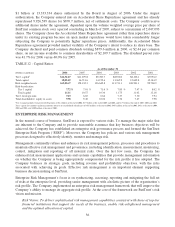

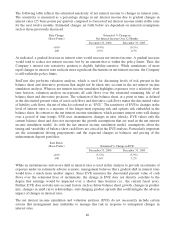

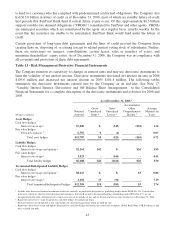

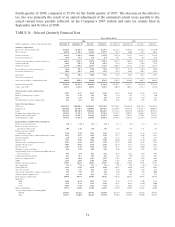

Table 13 - Risk Management Derivative Financial Instruments

The Company monitors its sensitivity to changes in interest rates and may use derivative instruments to

limit the volatility of net interest income. Derivative instruments decreased net interest income in 2006

$105.6 million and increased net interest income in 2005 $104.4 million. The following tables

summarize the derivative instruments entered into by the Company as an end-user. See Note 17,

“Variable Interest Entities, Derivatives and Off-Balance Sheet Arrangements,” to the Consolidated

Financial Statements for a complete description of the derivative instruments and activities for 2006 and

2005.

As of December 31, 2006 1

(Dollars in millions)

Notional

Amount

Gross

Unrealized

Gains 6

Gross

Unrealized

Losses 6

Accumulated

Other

Comprehensive

Income 9

Average

Maturity in

Years

Asset Hedges

Cash flow hedges

Interest rate swaps 2$7,000 $- ($15) ($10) 1.34

Fair value hedges

Forward contracts 36,787 9 (6) - 0.07

Total asset hedges $13,787 $9 ($21) ($10) 0.72

Liability Hedges

Cash flow hedges

Interest rate swaps and options 4$2,265 $42 $- $26 1.95

Fair value hedges

Interest rate swaps 53,823 - (166) - 4.41

Total liability hedges $6,088 $42 ($166) $26 3.50

Terminated/Dedesignated Liability Hedges

Cash flow hedges

Interest rate swaps and options 7$8,615 $- $- $3 0.86

Fair value hedges

Interest rate swaps 83,694 15 (91) - 7.19

Total terminated/dedesignated hedges $12,309 $15 ($91) $3 2.76

1Includes only derivative financial instruments which are currently, or previously designated as, qualifying hedges under SFAS No. 133. Certain other

derivatives which are effective for risk management purposes, but which are not in designated hedging relationships under SFAS No. 133, are not

incorporated in this table. All interest rate swaps have resets of six months or less and are the pay and receive rates in effect as of December 31, 2006.

2Represents interest rate swaps designated as cash flow hedges of commercial loans.

3Forward contracts are designated as fair value hedges of closed mortgage loans which are held for sale.

4Represents interest rate swaps and options designated as cash flow hedges of floating rate certificates of deposit, Global Bank Notes, FHLB Advances and

other variable rate debt.

43