SunTrust 2006 Annual Report Download - page 46

Download and view the complete annual report

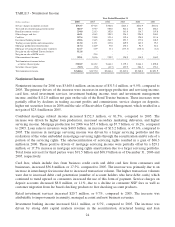

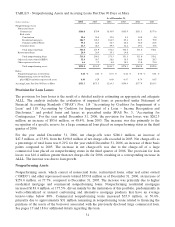

Please find page 46 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As part of the restructuring, the Company sold $4.4 billion of shorter-term securities across several

categories, namely mortgage-backed and agency securities, with a 3.62% yield and reinvested

approximately $2.4 billion in longer-term securities with a 5.55% yield. In addition to reinvesting in

these securities, $1.5 billion of receive-fixed interest rate swaps on commercial loans were executed at

5.50% to extend the duration of the balance sheet and improve the earning asset yield. Securities losses

of $116.1 million were realized in conjunction with the restructuring. These losses represented

approximately 2.6% of the securities sold. The underlying securities began gradually incurring

unrealized losses approximately two years ago in connection with the increase in interest rates. The

Company’s analysis indicated that the combination of these steps were sufficient to achieve its current

asset liability management objectives. The Company continues to monitor economic and Company

specific performance in order to determine if incremental balance sheet management tactics are

appropriate.

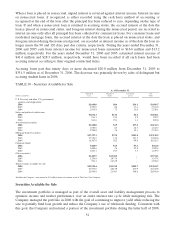

The average yield for 2006 improved to 4.93% compared to 4.50% for 2005. The average yield

continued to improve to 5.12% for the fourth quarter of 2006. The Company lengthened the estimated

average life of the portfolio from 3.3 years at December 31, 2005 to 4.2 years at December 31, 2006.

Likewise, the portfolio’s average duration increased from 2.8 as of December 31, 2005 to 3.5 as of

December 31, 2006. Duration is a measure of the estimated price sensitivity of a bond portfolio to an

immediate change in interest rates. A duration of 3.5 suggests an expected price change of 3.5% for a

one percent change in interest rates, without considering any embedded call or prepayment options. The

size of the securities portfolio decreased $1.4 billion to $25.1 billion, or 13.8%, of total assets at

December 31, 2006, down from $26.5 billion or 14.8% of total assets at December 31, 2005. Net

securities losses of $50.5 million were realized during 2006, primarily due to the repositioning of the

securities portfolio, but were partially offset by gains realized on equity positions sold by the Company

in 2006. Net securities losses realized for the year ended December 31, 2005 were $7.2 million

compared to net losses of $41.7 million realized for the year ended December 31, 2004. The current mix

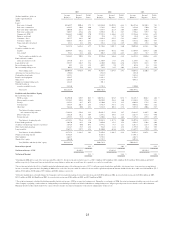

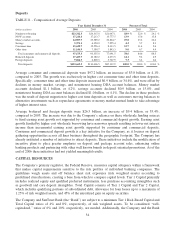

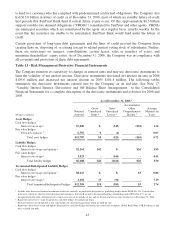

of securities as of December 31, 2006 is shown in Table 10.

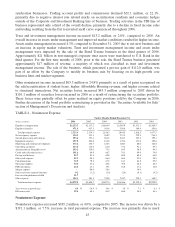

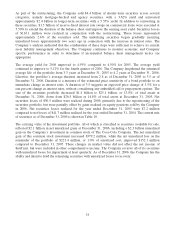

The carrying value of the investment portfolio, all of which is classified as securities available for sale,

reflected $2.1 billion in net unrealized gains at December 31, 2006, including a $2.3 billion unrealized

gain on the Company’s investment in common stock of The Coca-Cola Company. The net unrealized

gain of this common stock investment increased $379.2 million, while the net unrealized loss on the

remainder of the portfolio of $221.4 million, or 1.0% of amortized cost, improved $152.1 million

compared to December 31, 2005. These changes in market value did not affect the net income of

SunTrust, but were included in other comprehensive income. The Company reviews all of its securities

with unrealized losses for impairment at least quarterly. As of December 31, 2006, the Company has the

ability and intent to hold the remaining securities with unrealized losses to recovery.

33