SunTrust 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

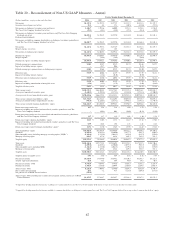

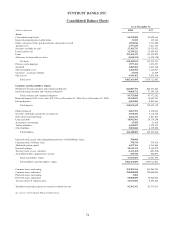

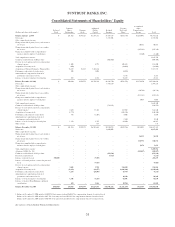

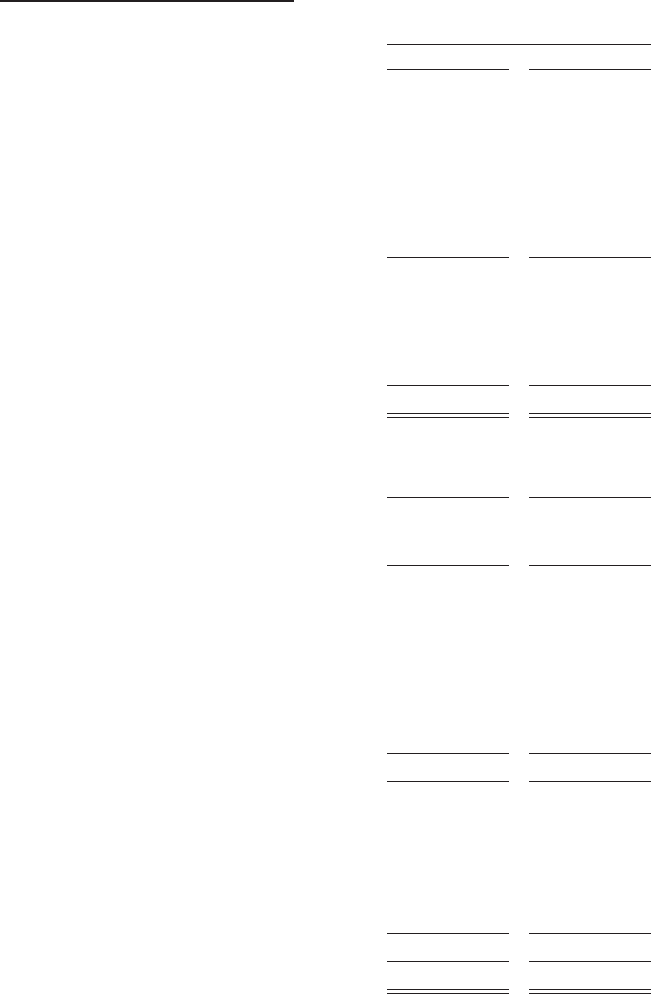

SUNTRUST BANKS, INC.

Consolidated Balance Sheets

As of December 31

(Dollars in thousands) 2006 2005

Assets

Cash and due from banks $4,235,889 $4,659,664

Interest-bearing deposits in other banks 21,810 332,444

Funds sold and securities purchased under agreements to resell 1,050,046 1,313,498

Trading assets 2,777,629 2,811,225

Securities available for sale125,101,715 26,525,821

Loans held for sale 11,790,122 13,695,613

Loans 121,454,333 114,554,895

Allowance for loan and lease losses (1,044,521) (1,028,128)

Net loans 120,409,812 113,526,767

Premises and equipment 1,977,412 1,854,527

Goodwill 6,889,860 6,835,168

Other intangible assets 1,181,984 1,122,967

Customers’ acceptance liability 15,878 11,839

Other assets 6,709,452 7,023,308

Total assets $182,161,609 $179,712,841

Liabilities and Shareholders’ Equity

Noninterest-bearing consumer and commercial deposits $22,887,176 $26,327,663

Interest-bearing consumer and commercial deposits 76,888,712 71,244,719

Total consumer and commercial deposits 99,775,888 97,572,382

Brokered deposits (CDs at fair value: $97,370 as of December 31, 2006; $0 as of December 31, 2005) 18,150,059 15,644,932

Foreign deposits 6,095,682 8,835,864

Total deposits 124,021,629 122,053,178

Funds purchased 4,867,591 4,258,013

Securities sold under agreements to repurchase 6,950,426 6,116,520

Other short-term borrowings 2,062,636 1,937,624

Long-term debt 18,992,905 20,779,249

Acceptances outstanding 15,878 11,839

Trading liabilities 1,634,097 1,529,325

Other liabilities 5,802,841 6,139,698

Total liabilities 164,348,003 162,825,446

Preferred stock, no par value (liquidation preference of $100,000 per share) 500,000 -

Common stock, $1.00 par value 370,578 370,578

Additional paid in capital 6,627,196 6,761,684

Retained earnings 10,541,152 9,310,978

Treasury stock, at cost, and other (1,151,269) (493,936)

Accumulated other comprehensive income 925,949 938,091

Total shareholders’ equity 17,813,606 16,887,395

Total liabilities and shareholders’ equity $182,161,609 $179,712,841

Common shares outstanding 354,902,566 361,984,193

Common shares authorized 750,000,000 750,000,000

Preferred shares outstanding 5,000 -

Preferred shares authorized 50,000,000 50,000,000

Treasury shares of common stock 15,675,832 8,594,205

1Includes net unrealized gains on securities available for sale $2,103,362 $1,572,033

See notes to Consolidated Financial Statements.

74