SunTrust 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Trading Activities

Most of the Company’s trading activities are designed to support secondary trading with customers.

Product offerings to customers include debt securities, including loans traded in the secondary market,

equity securities, derivatives and foreign exchange contracts, and similar financial instruments. Other

trading activities include participating in underwritings, and acting as a market maker in certain equity

securities. Typically, the Company maintains a securities inventory to facilitate customer transactions.

However, in certain businesses, such as derivatives, it is more common to execute customer transactions

with simultaneous risk-managing transactions with dealers. Also in the normal course of business, the

Company assumes a degree of market risk in arbitrage, hedging, and other strategies, subject to

specified limits.

The Company has developed policies and procedures to manage market risk associated with trading,

capital markets and foreign exchange activities using a value-at-risk (“VaR”) approach that combines

interest rate risk, equity risk, foreign exchange risk, spread risk and volatility risk. For trading portfolios,

VaR measures the maximum fair value the Company could lose on a trading position, given a specified

confidence level and time horizon. VaR limits and exposures are monitored daily for each significant

trading portfolio. The Company’s VaR calculation measures the potential losses in fair value using a

99% confidence level. This equates to 2.33 standard deviations from the mean under a normal

distribution. This means that, on average, daily profits and losses are expected to exceed VaR one out of

every 100 overnight trading days. The VaR methodology includes holding periods for each position

based upon an assessment of relative trading market liquidity. For the foreign exchange, equities,

structured trades and derivatives desks, the Company estimates VaR by applying the Monte Carlo

simulation platform as designed by RiskMetrics™, and for the estimate of the fixed income VaR, the

Company uses Bloomberg™analytics. For equity derivatives, the Imagine system is used for VaR. The

Company uses an internally developed methodology to estimate VaR for the collateralized debt

obligations and loan trading desks.

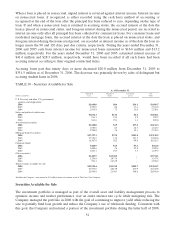

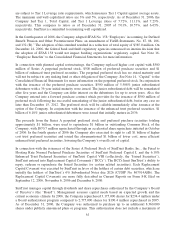

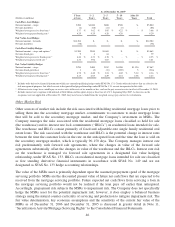

The estimated average combined Undiversified VaR (Undiversified VaR represents a simple summation

of the VaR calculated across each Desk) was $4.8 million for 2006 and $4.1 million for 2005. Trading

assets net of trading liabilities averaged $1.5 billion for 2006 and $1.4 billion for 2005. The estimated

combined period-end Undiversified VaR was $3.5 million at December 31, 2006 and $4.4 million at

December 31, 2005. Trading assets net of trading liabilities were $1.1 billion at December 31, 2006 and

$1.3 billion at December 31, 2005.

Liquidity Risk

Liquidity risk is the risk of being unable to meet obligations as they come due at a reasonable funding

cost. SunTrust manages this risk by structuring its balance sheet prudently and by maintaining

borrowing resources to fund potential cash needs. The Company assesses liquidity needs in the form of

increases in assets, maturing obligations, or deposit withdrawals, considering both operations in the

normal course of business and in times of unusual events. In addition, the Company considers the

off-balance sheet arrangements and commitments it has entered into, which could also affect the

Company’s liquidity position. The ALCO of the Company measures this risk, sets policies, and reviews

adherence to those policies.

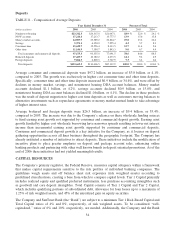

The Company’s sources of funds include a large, stable deposit base, secured advances from the Federal

Home Loan Bank (“FHLB”) and access to the capital markets. The Company structures its balance sheet

so that illiquid assets, such as loans, are funded through customer deposits, long-term debt, other

liabilities and capital. Customer based core deposits, the Company’s largest and most cost-effective

source of funding, accounted for 62.6% of the funding base on average for 2006 compared to 64.3% for

41