SunTrust 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

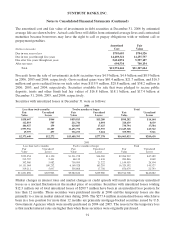

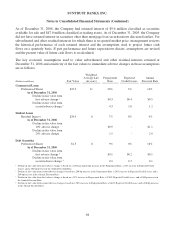

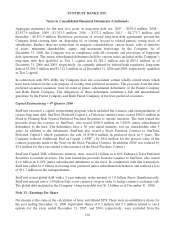

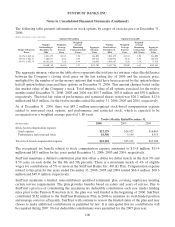

As of December 31, 2006, the Company had retained interest of $9.6 million classified as securities

available for sale and $47.0 million classified as trading assets. As of December 31, 2005, the Company

did not have retained interest in securities other than mortgage loan securitizations discussed earlier. For

subordinated and other residual interests for which there is no quoted market price, management reviews

the historical performance of each retained interest and the assumptions used to project future cash

flows on a quarterly basis. If past performance and future expectations dictate, assumptions are revised

and the present value of future cash flows is recalculated.

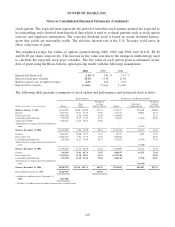

The key economic assumptions used to value subordinated and other residual interests retained at

December 31, 2006 and sensitivity of the fair values to immediate adverse changes in those assumptions

are as follows:

(Dollars in millions) Fair Value

Weighted

Average Life

(in years)

Prepayment

Rate

Expected

Credit Losses

Annual

Discount Rate

Commercial Loans

Preferenced Shares $22.9 11 20% 2% 14%

As of December 31, 2006

Decline in fair value from

first adverse change 1$0.3 $0.4 $0.5

Decline in fair value from

second adverse change 20.3 1.0 1.2

Student Loans

Residual Interest $24.4 6 7% 0% 9%

As of December 31, 2006

Decline in fair value from

10% adverse change $0.9 - $1.1

Decline in fair value from

20% adverse change 1.5 - 2.0

Debt Securities

Preferenced Shares $1.5 8 9% 0% 16%

As of December 31, 2006

Decline in fair value from

first adverse change 3$0.1 $0.2 $0.1

Decline in fair value from

second adverse change 40.2 0.7 0.1

1Decline in fair value from first adverse change is based on a 100 basis point (bp) increase in the Prepayment Rate, a 10% increase in Expected Credit

Losses, and a 100 bp increase in the Annual Discount Rate.

2Decline in fair value from second adverse change is based on a 200 bp increase in the Prepayment Rate, a 20% increase in Expected Credit Losses, and a

200 bp increase in the Annual Discount Rate.

3Decline in fair value from first adverse change is based on a 25% increase in Prepayment Rate, a 0.20% Expected Credit Losses, and a 100 bp increase in

the Annual Discount Rate.

4Decline in fair value from second adverse change is based on a 50% increase in Prepayment Rate, a 0.60% Expected Credit Losses, and a 200 bp increase

in the Annual Discount Rate.

98