SunTrust 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Mission: To promote a strong risk management culture which facilitates accountability, risk-

informed decisions consistent with the bank’s strategic objectives and the creation of shareholder

value.

The Company’s Chief Risk Officer (“CRO”) reports to the Chief Executive Officer and is responsible

for the oversight of the risk management organization as well as risk governance processes. The CRO

provides overall leadership, vision and direction for the Company’s enterprise risk management

framework.

In addition to the centralized Enterprise Risk Management function, each line of business and corporate

function has its own Risk Manager and support staff. These Risk Managers, while reporting directly to

their respective line of business or function, facilitate communications with the Company’s risk

functions and execute the requirements of the enterprise risk management framework and policies.

Enterprise Risk Management works in partnership with the Risk Managers to ensure alignment with

sound risk management practices as well as industry best practices.

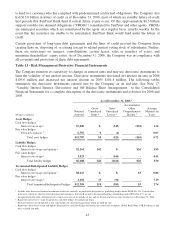

Organizationally, the Company measures and manages risk according to three main risk categories:

credit risk, market risk (including liquidity risk) and operational risk (including compliance risk). The

Chief Credit Officer manages the Company’s credit risk program. The Chief Financial Officer and

Treasurer manage the Company’s market risk program. The Chief Operational Risk Officer manages the

Company’s operational risk program. These three areas of risk are managed on a consolidated basis

under the Company’s enterprise risk management framework, which also takes into consideration legal

and reputational risk factors.

In 2006, SunTrust continued to make significant enhancements to its enterprise risk management

function. The Model Validation and Enterprise Risk Measurement groups continued to provide

reasonable assurance that risks inherent in model development and usage are properly identified and

managed, and they continued to oversee the calculation of economic capital respectively. Risk

identification, assessment and mitigation planning were formally incorporated into the strategic

planning process. SERP continued to ensure that the approach and plans for risk management are

aligned to the vision and mission of Enterprise Risk Management and manage regulatory compliance. In

addition, SERP’s goal is to ensure the Company’s future compliance with the Basel II Capital Accord.

Key objectives of SERP include incorporating risk management principles that encompass Company

values and standards and are designed to guide risk-taking activity, maximizing performance through

the balance of risk and reward and leveraging initiatives driven by regulatory requirements to deliver

capabilities to better measure and manage risk.

As part of its risk governance framework, the Company has also established various risk management-

related committees. These committees are jointly responsible for ensuring adequate risk measurement

and management in their respective areas of authority. These committees include: Asset/Liability

Management Committee (“ALCO”), Corporate Product Risk Assessment Committee (“PRAC”), Credit

Management Committee and SERP Steering Committee. Additionally, the Company has established an

Enterprise Risk Committee (“ERC”), chaired by the CRO, which is responsible for supporting the CRO

in measuring and managing the Company’s aggregate risk profile. The ERC consists of various senior

executives throughout the Company and meets on a monthly basis.

The Board of Directors is wholly responsible for oversight of the Company’s corporate risk governance

process. The Risk Committee of the Board, which was formed in 2005, assists the Board of Directors in

executing this responsibility.

37