SunTrust 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2SUNTRUST 2006 ANNUAL REPORT

BUSINESS HIGHLIGHTS

SunTrust operates five primary lines of business, each of which

displayed continuing momentum in 2006. Highlights include:

•In Retail Banking, in addition to enhancing our branch presence,

we upgraded our online banking capabilities for small business

clients and placed a high priority on deposit products. A series

of creative deposit-generation promotions featured partnerships

with other well-known brands such as Equifax and, in early

2007, AirTran Airways, to attract new clients and bring

added value to existing ones. The Retail line of business

also expanded its cross selling focus by partnering with the

Mortgage and Wealth and Investment Management lines of

business to implement enhanced referral programs.

•Growth within the Commercial Banking line of business further

validated the merits of our distinctive relationship management

strategy. To capitalize on this strategy and sustain revenue

growth, we expanded our sales force in key markets. Investing

in new sales and advisory tools in our core businesses yielded

accelerated cross-sales of capital markets, commercial

mortgage backed securities, and retirement plan products.

Stepped-up investment in our Treasury & Payments

Solutions unit enhanced our overall competitive position

and leadership in image-based technologies, resulting in an

improved client experience for our business clients as well

as higher sales volumes.

•The Mortgage line of business had another outstanding

year, characterized by continued expansion in this national

business line. We opened 65 new mortgage offices and

increased the sales force by more than 16 percent. Despite

reduced industry volume, origination volume at SunTrust set

a record in 2006, growing by more than 16 percent. We are

particularly proud that, in 2006, the well-respected J.D.

Power and Associates ranked SunTrust Mortgage “Highest in

Customer Satisfaction with Primary Mortgage Sales.” 1

Looking ahead, we launched a targeted efficiency initiative

called the “Mortgage Transformation Program.” With

complete implementation scheduled for 2007, the goal is

to ensure that our Mortgage line of business is configured

for consistent growth under different economic conditions

and housing market trends.

•In Corporate and Investment Banking, investments in

our capital markets product capabilities, capacity and

intellectual capital continued to bring value to our clients.

The Debt Capital Markets group, in particular, posted

meaningful growth in asset securitization, structured real

estate, derivatives, and primary bonds, as we delivered

solutions to our Corporate Banking, Commercial Banking,

Wealth and Investment Management and institutional

investor clients. Cross-selling capital markets products

to SunTrust’s Commercial Banking and Wealth and

Investment Management client bases remains a priority.

•In Wealth and Investment Management, we grew proven

competencies in Sports & Entertainment Banking, broadened

other specialties in the legal and medical industries and

focused new resources on the private business owner. In Private

Wealth Management, we established a framework to build out

our investment platform to offer greater customization of

solutions while working to enhance the client experience

and provide meaningful advice in a fast-changing investment

environment. Through the building of a streamlined

management organization, coupled with investment in

talent and platforms/solutions, our Institutional Investment

Management business continued to make a major contribution.

Reflecting the growth potential in this business, our ultra-

high-net-worth, multi-family arm, Asset Management

Advisors (AMA), experienced impressive growth in 2006.

AMA’s total assets under advisement of almost $10 billion

represent a 25 percent increase over last year.

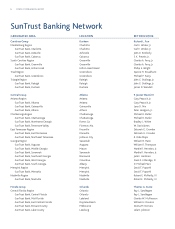

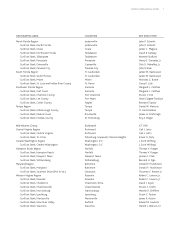

For most individual clients, the focal point for delivery of SunTrust

products and services is our extensive geographic network, which

encompasses more than 1,700 branches and specialized banking

facilities and almost 2,600 ATMs throughout the high-growth

Southeast and Mid-Atlantic regions. This network is complemented

by an array of technology-based “24/7” banking channels including

our award-winning SunTrust Online telephone banking operation

and our increasingly popular internet banking site.

Regardless of delivery channel, our approach to serving clients is

institutionalized in a highly energized sales effort, which we call

“S3: Sell, Serve and Sustain.” It is coupled with a “Thinking 360°”

view of the client relationship, meaning that we look at client

needs across the full range of SunTrust product offerings. This

distinctive approach is reflected in high volume of cross-sales

across our lines of business. From a competitive standpoint,

1SunTrust Mortgage received the highest numerical score among mortgage lenders in

the proprietary J.D. Power and Associates 2006 Primary Mortgage Origination Study.

Study based on 4,115 total responses measuring 20 lenders and measures opinions of

consumers who originated a new mortgage in the past nine months. Proprietary

study results are based on experiences and perceptions of consumers surveyed in

September – November 2006. Your experiences may vary. Visit jdpower.com.