SunTrust 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

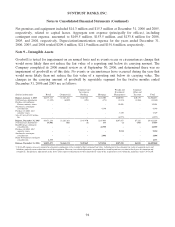

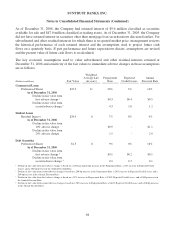

investment strategies for clients. The transaction resulted in $39.8 million of goodwill and $11.1 million

of other intangibles related to client relationships and noncompete agreements which were both

deductible for tax purposes.

On October 1, 2004, SunTrust acquired National Commerce Financial Corporation and subsidiaries, a

Memphis-based financial services organization. NCF’s parent company merged into SunTrust in a

transaction that qualified as a tax-free reorganization. The acquisition was accounted for under the

purchase method of accounting with the results of operations for NCF included in SunTrust’s results

beginning October 1, 2004. Under the purchase method of accounting the assets and liabilities of the

former NCF were recorded at their respective fair values as of October 1, 2004. The consideration for

the acquisition was a combination of cash and stock with an aggregate purchase price of approximately

$7.4 billion. The total consideration consisted of approximately $1.8 billion in cash and approximately

76.4 million shares of SunTrust common stock. Based on a valuation of their estimated useful lives, the

core deposit intangibles are being amortized over a 10 year period using the sum of the years digit

method and the other intangibles will be amortized over a weighted average of 7.3 years using the

straight line method. No goodwill related to NCF was deductible for tax purposes. The Company

incurred $98.6 million and $28.4 million in merger expenses in 2005 and 2004, respectively, which

represent incremental costs to integrate NCF’s operations. More specifically, these represent costs

related to consulting fees for systems and other integration initiatives, employee-related charges and

marketing expenditures.

On May 28, 2004, SunTrust acquired substantially all of the assets of Seix Investment Advisors, Inc

(“Seix”). The Company acquired approximately $17 billion in assets under management. The Company

paid $190 million in cash, resulting in $84.0 million of goodwill and $99.2 million of other intangible

assets, all of which are deductible for tax purposes. Additional payments may be made in 2007 and

2009, contingent on performance. The additional payments are currently estimated to total

approximately $58.0 million.

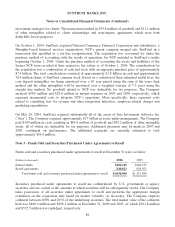

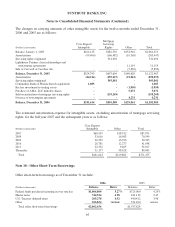

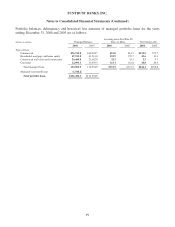

Note 3 - Funds Sold and Securities Purchased Under Agreements to Resell

Funds sold and securities purchased under agreements to resell at December 31 were as follow:

(Dollars in thousands) 2006 2005

Federal funds $209,225 $384,575

Resell agreements 840,821 928,923

Total funds sold and securities purchased under agreements to resell $1,050,046 $1,313,498

Securities purchased under agreements to resell are collateralized by U.S. government or agency

securities and are carried at the amounts at which securities will be subsequently resold. The Company

takes possession of all securities under agreements to resell and performs the appropriate margin

evaluation on the acquisition date based on market volatility, as necessary. The Company requires

collateral between 100% and 105% of the underlying securities. The total market value of the collateral

held was $849.9 million and $958.1 million at December 31, 2006 and 2005, of which $561.8 million

and $572.5 million was repledged, respectively.

89