SunTrust 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

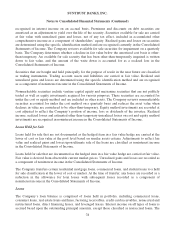

Notes to Consolidated Financial Statements (Continued)

Derivatives entered into in a dealer capacity and those that either do not qualify for, or for which the

Company has elected not to apply, hedge accounting are accounted for as free standing derivatives. As

such, those derivatives are carried at fair value on the balance sheet, with changes in fair value recorded

in noninterest income.

When a derivative is intended to be a qualifying hedging instrument, the Company prepares written

hedge documentation that designates the derivative as (1) a hedge of the fair value of a recognized asset

or liability or of an unrecognized firm commitment (fair value hedge) or (2) a hedge of a forecasted

transaction, such as, the variability of cash flows to be received or paid related to a recognized asset or

liability (cash flow hedge). The Company currently does not have any hedges of net investments in

foreign operations. The written hedge documentation includes identification of, among other items, the

risk management objective, hedging instrument, hedged item and methodologies for assessing and

measuring hedge effectiveness and ineffectiveness, along with support for management’s assertion that

the hedge will be highly effective. Methodologies related to hedge effectiveness and ineffectiveness are

consistent between similar types of hedge transactions and have included (i) statistical regression

analysis of changes in the cash flows of the actual derivative and a perfectly effective hypothetical

derivative, (ii) statistical regression analysis of changes in the fair values of the actual derivative and the

hedged item and (iii) comparison of the critical terms of the hedged item and the hedging derivative.

Changes in the fair value of a derivative that is highly effective and that has been designated and

qualifies as a fair value hedge are recorded in current period earnings, along with the changes in the fair

value of the hedged asset or liability that are attributable to the hedged risk. Changes in the fair value of

a derivative that is highly effective and that has been designated and qualifies as a cash flow hedge are

initially recorded in other comprehensive income and reclassified to earnings in conjunction with the

recognition of the earnings impacts of the hedged item; any ineffective portion is recorded in current

period earnings. Designated hedge transactions are reviewed at least quarterly for ongoing effectiveness.

Transactions that are no longer deemed effective, or for which the derivative has been terminated or

de-designated, are removed from hedge accounting classification and the recorded impacts of the hedge

are recognized in current period interest income or expense in conjunction with the recognition of the

income or expense on the originally hedged item.

In addition to freestanding derivatives, the Company also evaluates contracts to determine whether any

embedded derivatives exist and accounts for such embedded derivatives in accordance with the

provisions of SFAS No. 133. However, the Company adopted the provisions of SFAS No. 155, as of

January 1, 2006, which permits an election to carry at fair value contracts containing embedded

derivatives.

For additional information on the Company’s derivative activities, refer to Note 17, “Variable Interest

Entities, Derivatives, and Off-Balance Sheet Arrangements”, to the Consolidated Financial Statements.

Stock-based Compensation

The Company sponsors stock option plans under which incentive and nonqualified stock options may be

granted periodically to certain employees. The Company’s stock options typically have an exercise price

equal to the fair value of the stock on the date of the grant and typically vest over three years. The

Company accounted for all awards granted after January 1, 2002 under the fair value recognition

provisions of SFAS No. 123, “Accounting for Stock-Based Compensation.” The required disclosures

related to the Company’s stock-based employee compensation plan are included in Note 16, “Employee

82