SunTrust 2006 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

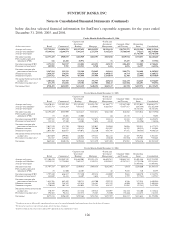

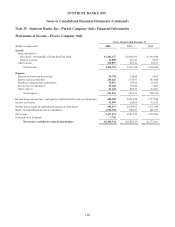

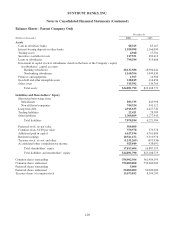

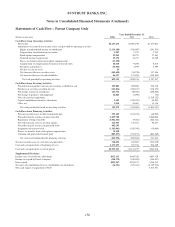

Notes to Consolidated Financial Statements (Continued)

Corporate and Investment Banking provides advisory services, debt and equity capital raising solutions,

financial risk management capabilities, and debt and equity sales and trading for the Corporation’s

clients as well as traditional lending, leasing, treasury management services and institutional investment

management to middle and large corporate clients.

Wealth and Investment Management provides a full array of wealth management products and

professional services to both individual and institutional clients. Wealth and Investment Management’s

primary segments include Private Wealth Management (brokerage and individual wealth management),

Asset Management Advisors and Institutional Investment Management and Administration. On

September 29, 2006, the Company sold its Bond Trustee business unit, which was a part of the Wealth

and Investment Management line of business. The sale was part of an effort by the Company to modify

its business mix to focus on its high-growth core business lines and market segments. See Note 2,

“Acquisitions/Dispositions,” to the Consolidated Financial Statements for additional details.

The Mortgage line of business offers residential mortgage products nationally through its retail, broker

and correspondent channels. These products are either sold in the secondary market primarily with

servicing rights retained or held as whole loans in the Company’s residential loan portfolio. The line of

business services loans for its own residential mortgage portfolio as well as for others. Additionally, the

line of business generates revenue through its tax service subsidiary (ValuTree Real Estate Services,

LLC) and its captive reinsurance subsidiary (Cherokee Insurance Company).

In addition, the Company reports a Corporate Other and Treasury segment which includes the

investment securities portfolio, long-term debt, capital, short-term liquidity and funding activities,

balance sheet risk management including derivative hedging activities, and certain support activities not

currently allocated to the aforementioned lines of business. Any internal management reporting

transactions not already eliminated in the results of the functional lines of business are reflected in

Reconciling Items.

The Company continues to augment its internal management reporting methodologies. Currently, the

lines of business’ financial performance is comprised of direct financial results as well as various

allocations that for internal management reporting purposes provides an enhanced view of analyzing the

line of business’ financial performance. The internal allocations include the following: match maturity

funds transfer pricing and a fully taxable-equivalent (“FTE”) gross-up on tax exempt loans and

securities to create net interest income, occupancy expense (inclusive of the cost to carry the assets),

various support costs such as operational, human resource and corporate finance, certain product-related

expenses incurred within production support areas, and overhead costs. Beginning January 2006,

income tax expense was calculated based on a marginal income tax rate which was modified to reflect

the impact of various income tax adjustments and credits that are unique to each business segment.

Future enhancements to line of business segment profitability reporting are expected to include the

attribution of economic capital and the use of a provision for loan losses that uses a combination of net

charge-offs and expected loss in lieu of net charge-offs. Currently, for credit related costs of the lines of

business, the Company uses net charge-offs as an estimate of the provision for loan losses. The

implementation of these enhancements to the internal management reporting methodology may

materially affect the net income disclosed for each segment with no impact on consolidated amounts.

Whenever significant changes to management reporting methodologies take place, the impact of these

changes is quantified and prior period information is reclassified wherever practicable. The Company

will reflect these reclassified changes in the current period and will update historical results. The tables

125