SunTrust 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

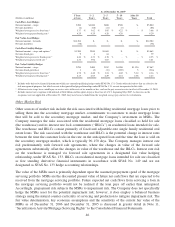

to loss related to its affordable housing limited partner investments consists of the limited partnership

equity investments, unfunded equity commitments, and debt issued by the Company to the limited

partnerships.

SunTrust is the managing general partner of a number of private investment limited partnerships which

have been established to provide alternative investment strategies for its clients. In reviewing the

partnerships for consolidation, SunTrust determined that these were voting interest entities and

accordingly considered the consolidation guidance contained in Emerging Issues Task Force (“EITF”)

Issue No. 04-5, “Determining Whether a General Partner, or the General Partners as a Group, Controls a

Limited Partnership or Similar Entity When the Limited Partners Have Certain Rights.” Under the terms

of SunTrust’s non-registered investment limited partnerships, the limited partnerships have certain

rights, such as the right to remove the general partner, or “kick-out rights”, as indicated in EITF Issue

No. 04-5. Therefore, SunTrust, as the general partner, is precluded from consolidating the limited

partnerships.

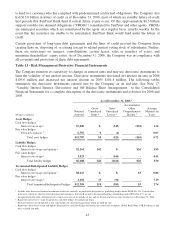

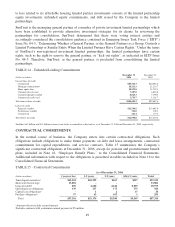

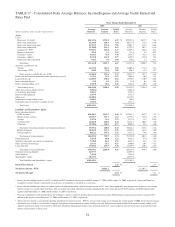

TABLE 14 - Unfunded Lending Commitments

(Dollars in millions)

December 31

2006

December 31

2005

Unused lines of credit

Commercial $40,764.3 $40,584.6

Mortgage commitments128,232.1 21,216.7

Home equity lines 18,959.8 15,712.3

Commercial real estate 7,187.0 6,818.0

Commercial paper conduit 8,022.3 7,190.3

Commercial credit card 1,519.7 1,165.7

Total unused lines of credit $104,685.2 $92,687.6

Letters of credit

Financial standby $12,540.6 $13,005.0

Performance standby 334.0 328.1

Commercial 123.4 177.3

Total letters of credit $12,998.0 $13,510.4

1Includes $6.2 billion and $3.1 billion in interest rate locks accounted for as derivatives as of December 31, 2006 and December 31, 2005, respectively.

CONTRACTUAL COMMITMENTS

In the normal course of business, the Company enters into certain contractual obligations. Such

obligations include obligations to make future payments on debt and lease arrangements, contractual

commitments for capital expenditures, and service contracts. Table 15 summarizes the Company’s

significant contractual obligations at December 31, 2006, except for pension and postretirement benefit

plans, included in Note 16, “Employee Benefit Plans,” to the Consolidated Financial Statements.

Additional information with respect to the obligations is presented in tables included in Note 16 to the

Consolidated Financial Statements.

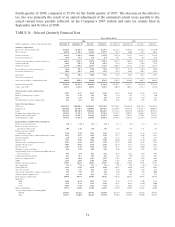

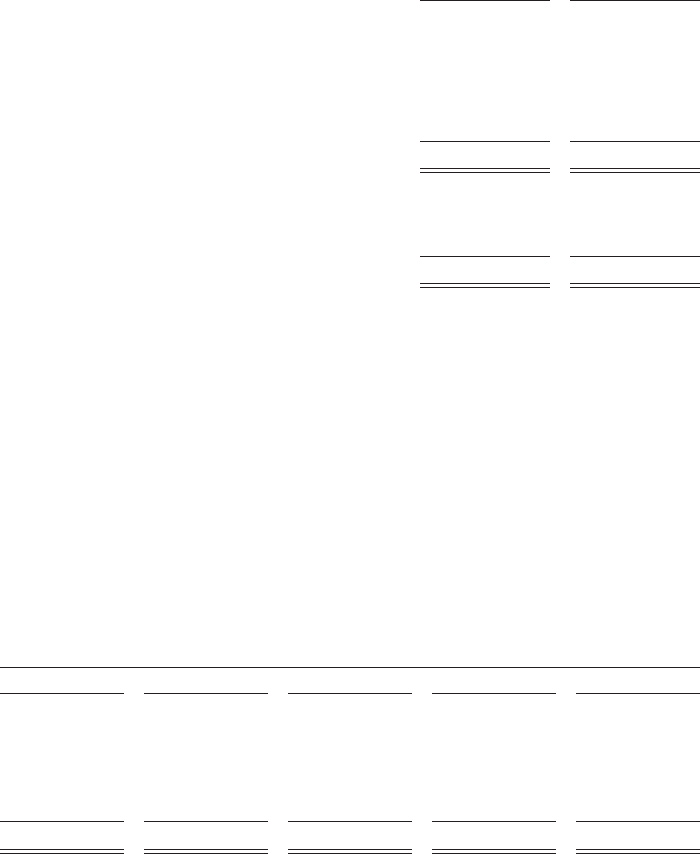

TABLE 15 - Contractual Commitments

As of December 31, 2006

(Dollars in millions) 1 year or less 1-3 years 3-5 years After 5 years Total

Time deposit maturities1$42,254 $10,295 $467 $317 $53,333

Short-term borrowings113,881 - - - 13,881

Long-term debt1870 4,600 4,644 8,859 18,973

Operating lease obligations 139 237 173 375 924

Capital lease obligations1-121720

Purchase obligations257 43 102 1 203

Total $57,201 $15,176 $5,388 $9,569 $87,334

1Amounts do not include accrued interest.

2Includes contracts with a minimum annual payment of $5 million.

49