SunTrust 2006 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

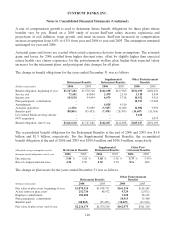

Assumed discount rates and expected returns on plan assets affect the amounts of net periodic benefit

cost. A 25 basis point decrease in the discount rate or expected long-term return on plan assets would

increase the Retirement Benefits net periodic benefit cost approximately $14 million and $6 million,

respectively.

Assumed healthcare cost trend rates have a significant effect on the amounts reported for the

postretirement plans. As of December 31, 2006, SunTrust assumed that retiree health care costs will

increase at an initial rate of 9.50% per year. SunTrust assumed a healthcare cost trend that recognizes

expected medical inflation, technology advancements, rising cost of prescription drugs, regulatory

requirements and Medicare cost shifting. SunTrust expects this annual cost increase to decrease over a

5-year period to 5.25% per year. Due to changing medical inflation, it is important to understand the

effect of a one-percent point change in assumed healthcare cost trend rates. These amounts are shown

below:

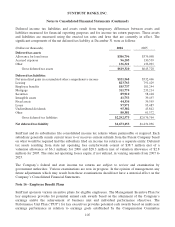

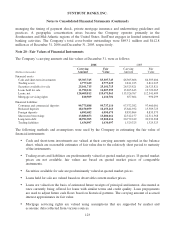

(Dollars in thousands) 1% Increase 1% Decrease

Effect on other postretirement benefit obligation $13,459 ($11,645)

Effect on total service and interest cost 698 (600)

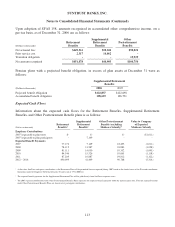

Note 17 - Variable Interest Entities, Derivatives, and Off-Balance Sheet Arrangements

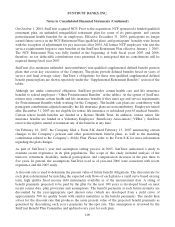

In the normal course of business, the Company utilizes various financial instruments to meet the needs

of clients and to manage the Company’s exposure to interest rate and other market risks. These financial

instruments, which consist of derivatives and credit-related arrangements, may involve, to varying

degrees, elements of credit and market risk in excess of the amount recorded on the Consolidated

Balance Sheets in accordance with generally accepted accounting principles.

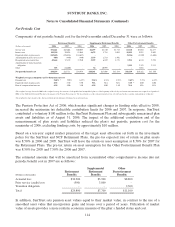

Credit risk represents the potential loss that may occur because a party to a transaction fails to perform

according to the terms of the contract. Market risk is the possibility that a change in market prices may

cause the value of a financial instrument to decrease or become more costly to settle. The contract/

notional amounts of financial instruments, which are not included in the Consolidated Balance Sheets,

do not necessarily represent credit or market risk. However, they can be used to measure the extent of

involvement in various types of financial instruments.

The Company manages the credit risk of its derivatives and unfunded commitments by limiting the total

amount of arrangements outstanding by individual counterparty, by monitoring the size and maturity

structure of the portfolio, by obtaining collateral based on management’s credit assessment of the

counterparty, and by applying uniform credit standards maintained for all activities with credit risk.

Collateral held varies but may include marketable securities, accounts receivable, inventory, property,

plant and equipment, and income-producing commercial properties. Collateral may cover the entire

expected exposure for transactions or may be called for when credit exposure exceeds defined

thresholds of credit risk. In addition, the Company enters into master netting agreements which

incorporate the right of setoff to provide for the net settlement of covered contracts with the same

counterparty in the event of default or other termination of the agreement.

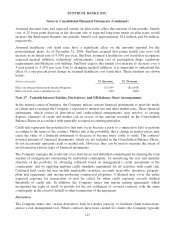

Derivatives

The Company enters into various derivatives both in a dealer capacity, to facilitate client transactions,

and as a risk management tool. Where contracts have been created for clients, the Company typically

115