SunTrust 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

Company’s Consolidated Balance Sheet were approximately $2.2 billion. At December 31, 2006, the

Company’s maximum exposure to loss related to these VIEs was approximately $32.2 million, which

represents the Company’s investment in preference shares. At December 31, 2005, the Company was

considered the primary beneficiary of one of these securitization vehicles and therefore, was required to

consolidate its assets and liabilities. As of December 31, 2005, the assets of the consolidated entity

totaled $317.0 million. The Company’s maximum exposure to loss for this VIE was $38.1 million as of

December 31, 2005. During 2006, the Company sold a majority of the equity in this securitization

vehicle and is no longer considered the primary beneficiary.

As part of its community reinvestment initiatives, the Company invests in multi-family affordable

housing properties throughout its footprint as a limited and/or general partner. The Company receives

affordable housing federal and state tax credits for these limited partner investments. Partnership assets

of approximately $756.9 million and $803.0 million in partnerships where SunTrust is only a limited

partner were not included in the Consolidated Balance Sheets at December 31, 2006 and 2005,

respectively. The Company’s maximum exposure to loss for these limited partner investments totaled

$330.6 million and $357.9 million at December 31, 2006 and 2005, respectively. The Company’s

maximum exposure to loss related to its affordable housing limited partner investments consists of the

limited partnership equity investments, unfunded equity commitments, and debt issued by the Company

to the limited partnerships.

SunTrust is the managing general partner of a number of non-registered investment limited partnerships

which have been established to provide alternative investment strategies for its clients. In reviewing the

partnerships for consolidation, SunTrust determined that these were voting interest entities and

accordingly considered the consolidation guidance contained in EITF Issue No. 04-5, “Determining

Whether a General Partner, or the General Partners as a Group, Controls a Limited Partnership or

Similar Entity When the Limited Partners Have Certain Rights.” Under the terms of SunTrust’s

non-registered investment limited partnerships, the limited partners have certain rights, such as the right

to remove the general partner, or “kick-out rights”, as indicated in EITF Issue No. 04-5. Therefore,

SunTrust, as the general partner, is precluded from consolidating the limited partnerships.

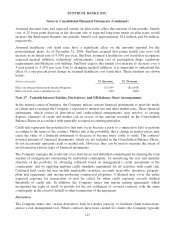

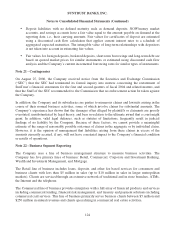

Note 18 – Guarantees

The Company has undertaken certain guarantee obligations in the ordinary course of business. In

following the provisions of FIN 45, the Company must consider guarantees that have any of the

following four characteristics: (i) contracts that contingently require the guarantor to make payments to

a guaranteed party based on changes in an underlying factor that is related to an asset, a liability, or an

equity security of the guaranteed party; (ii) contracts that contingently require the guarantor to make

payments to a guaranteed party based on another entity’s failure to perform under an obligating

agreement; (iii) indemnification agreements that contingently require the indemnifying party to make

payments to an indemnified party based on changes in an underlying factor that is related to an asset, a

liability, or an equity security of the indemnified party; and (iv) indirect guarantees of the indebtedness

of others. The issuance of a guarantee imposes an obligation for the Company to stand ready to perform,

and should certain triggering events occur, it also imposes an obligation to make future payments.

Payments may be in the form of cash, financial instruments, other assets, shares of stock, or provisions

of the Company’s services. The following is a discussion of the guarantees that the Company has issued

as of December 31, 2006, which have characteristics as specified by FIN 45.

120