SunTrust 2006 Annual Report Download - page 42

Download and view the complete annual report

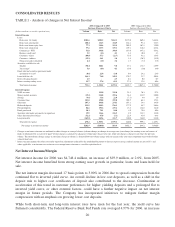

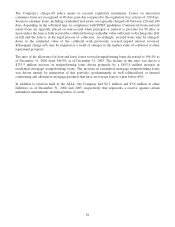

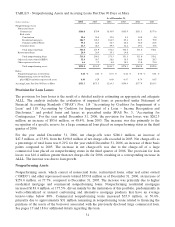

Please find page 42 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s charge-off policy meets or exceeds regulatory minimums. Losses on unsecured

consumer loans are recognized at 90-days past-due compared to the regulatory loss criteria of 120 days.

Secured consumer loans, including residential real estate, are typically charged-off between 120 and 180

days, depending on the collateral type, in compliance with FFIEC guidelines. Commercial loans and real

estate loans are typically placed on non-accrual when principal or interest is past-due for 90 days or

more unless the loan is both secured by collateral having realizable value sufficient to discharge the debt

in-full and the loan is in the legal process of collection. Accordingly, secured loans may be charged-

down to the estimated value of the collateral with previously accrued unpaid interest reversed.

Subsequent charge-offs may be required as a result of changes in the market value of collateral or other

repayment prospects.

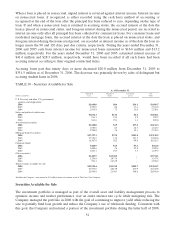

The ratio of the allowance for loan and lease losses to total nonperforming loans decreased to 196.4% as

of December 31, 2006 from 346.9% as of December 31, 2005. The decline in this ratio was due to a

$235.5 million increase in nonperforming loans driven primarily by a $183.4 million increase in

residential mortgage nonperforming loans. The increase in residential mortgage nonperforming loans

was driven mainly by maturation of this portfolio, predominantly in well-collateralized or insured

conforming and alternative mortgage products that have an average loan-to-value below 80%.

In addition to reserves held in the ALLL, the Company had $2.5 million and $3.6 million in other

liabilities as of December 31, 2006 and 2005, respectively that represents a reserve against certain

unfunded commitments, including letters of credit.

29