SunTrust 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Wealth and Investment Management

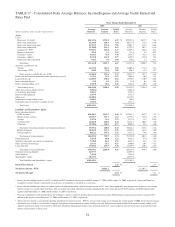

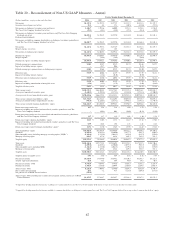

Wealth and Investment Management’s net income for the twelve months ended December 31, 2005 was

$187.2 million, an increase of $34.6 million, or 22.7%, compared to the same period in 2004. Organic

growth was the primary contributor to the increase, with NCF, Seix Investment Advisors (“Seix”) and

Zevenbergen Capital Investments, LLC (“ZCI”) also aiding results. Seix, a fixed income division of

Trusco, was formed following the acquisition of Seix Investment Advisors, Inc. in the second quarter of

2004. ZCI is a 55% owned subsidiary of Trusco and was consolidated in the fourth quarter of 2004. The

remainder of the growth was primarily driven by increased net interest income and noninterest income,

partially offset by higher personnel and operations expense and amortization of intangibles.

Fully taxable-equivalent net interest income increased $99.9 million, or 41.1%. NCF contributed

approximately $25 million to the increase. Average loans increased $1.6 billion, or 25.4%, including

approximately $754 million attributable to NCF. Average deposits increased $1.6 billion, or 20.6%,

including approximately $484 million attributable to NCF.

Provision for loan losses, which represents net charge-offs for the lines of business, increased $5.1

million when compared to the same period in 2004, primarily due to NCF.

Noninterest income increased $122.8 million, or 15.0%. NCF accounted for approximately $59 million

of the increase while Seix and ZCI accounted for approximately $30 million. The remainder of the

increase was primarily due to growth in recurring trust revenue and retail investment income. Assets

under management increased approximately $9.4 billion, or 7.5%, due to new business and an increase

in equity markets. As of December 31, 2005, assets under management were approximately $135.3

billion compared to $125.9 billion as of December 31, 2004. Assets under management include

individually managed assets, the STI Classic Funds, institutional assets managed by Trusco Capital

Management, and participant-directed retirement accounts. SunTrust’s total assets under advisement

were approximately $242.5 billion, which include the aforementioned assets under management, $45.5

billion in non-managed trust assets, $33.4 billion in retail brokerage assets, and $28.3 billion in

non-managed corporate trust assets.

Noninterest expense increased $150.5 million, or 18.2%. NCF, Seix and ZCI were the largest

contributors of the increase. The balance of the increase was driven by higher personnel expense due to

merit increases and selective hiring, and higher operations expense in an effort to build out the business.

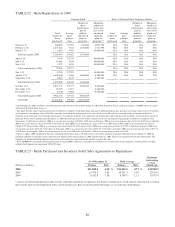

Corporate Other and Treasury

Corporate Other and Treasury’s net income for the twelve months ended December 31, 2005 was $75.0

million, an increase of $50.9 million from the same period in 2004. The increase was primarily due to

the acquisition of NCF and reduced securities losses.

Fully taxable-equivalent net interest income increased $22.8 million, or 251.9%. NCF represented

approximately $10 million of the increase. Additionally, net internal funding credits on other liabilities

and other assets increased a combined $30.1 million and was partially offset by a $20.4 million decrease

in income on interest rate swaps accounted for as cash flow hedges of floating rate commercial loans.

Total average assets increased $2.2 billion, or 7.2%, and total average liabilities increased $12.1 billion,

or 29.4%. NCF added approximately $4 billion in total average assets which was partially offset by a

reduction in the investment portfolio. The increase in liabilities was mainly due to growth in brokered

and foreign deposits of $6.9 billion.

Provision for loan losses increased $3.0 million, or 107.3%, due to the acquisition of NCF and an

increase in charge-offs at BankCard.

62