SunTrust 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

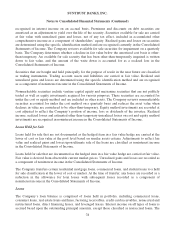

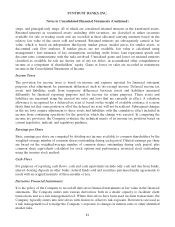

Notes to Consolidated Financial Statements (Continued)

Accounting Changes in Interim Financial Statements - an amendment of APB Opinion No. 28,” that

govern the reporting of accounting changes in interim financial statements. SFAS No. 154 is effective

for accounting changes and corrections of errors made in fiscal years beginning after December 15,

2005. The Company adopted the provisions of SFAS No. 154 on January 1, 2006. The adoption of this

Statement did not impact the Company’s financial position or results of operations.

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial

Instruments – an amendment of FASB Statements No. 133 and 140.” SFAS No. 155 requires companies

to evaluate interests in securitized financial assets to determine whether they are freestanding derivatives

or hybrid instruments that contain embedded derivatives requiring bifurcation from the host contract.

SFAS No. 155 also permits companies to measure certain hybrid financial instruments at fair value in

their entirety if they contain embedded derivatives that would otherwise require bifurcation in

accordance with SFAS No. 133. The election may be made on an instrument-by-instrument basis and is

irrevocable. Additionally, the Derivative Implementation Group (“DIG”) issued DIG Issues B38 and

B39 in June 2005, which both clarified whether certain options embedded in debt instruments require

bifurcation under SFAS No. 133. As of December 31, 2006, the FASB was working to finalize DIG

Issue B40, which will amend and clarify certain provisions of DIG B39 and the applicability of SFAS

No. 155 to certain instruments. SunTrust adopted SFAS No. 155 and DIG Issues B38 and B39 as of

January 1, 2006. The adoption of these pronouncements, along with consideration of the provisions of

DIG B40, did not have a material impact on the Company’s financial position or results of operations.

In March 2006, the FASB issued SFAS No. 156, “Accounting for Servicing of Financial Assets – an

amendment of FASB Statement No. 140.” This Statement requires that all separately recognized

servicing rights be initially measured at fair value. Subsequently, an entity may either recognize its

servicing rights at fair value or amortize its servicing rights over an estimated life and assess for

impairment at least quarterly. SFAS No. 156 also amends how gains and losses are computed in

transfers or securitizations that qualify for sale treatment in which the transferor retains the right to

service the transferred financial assets. Additional disclosures for all separately recognized servicing

rights are also required. This Statement is effective as of the beginning of the first fiscal year following

September 15, 2006. In accordance with SFAS No. 156, SunTrust will initially measure servicing rights

at fair value and will continue to subsequently amortize its servicing rights based on estimated future net

servicing income with at least quarterly assessments for impairment. The Company adopted the

provisions of SFAS No. 156 effective January 1, 2007 and the adoption did not have a material impact

on the Company’s financial position and results of operations.

In April 2006, the FASB issued FASB Staff Position (“FSP”) No. FIN 46(R)-6, “Determining the

Variability to Be Considered in Applying FASB Interpretation No. (“FIN”) 46(R).” The FSP states that

an evaluation of the design of the entity should be the single method used to understand variability when

applying FIN 46(R) as opposed to alternative methods used to measure the amount of variability. This

FSP introduces two steps to analyze the design of the entity and to determine the variability. Step one

requires an analysis of the nature of the risks in the entity including credit risk, interest rate risk, foreign

currency exchange risk, commodity price risk, equity price risk, and operations risk. Step two requires a

determination of the purpose for which the entity is created and determination of the variability the

entity is designed to create and pass along to its interest holders. Although this is a new approach, the

conclusions will often be the same under the guidance of this FSP as those reached using other

approaches. This FSP was applied on a prospective basis beginning July 1, 2006, to all entities that the

84