SunTrust 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

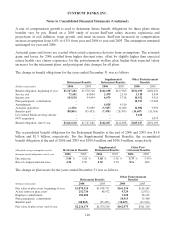

Notes to Consolidated Financial Statements (Continued)

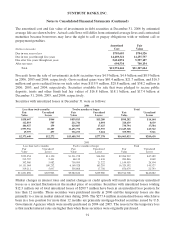

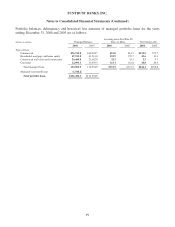

Aggregate maturities for the next five years on long-term debt are: 2007 – $870.0 million; 2008 –

$2,837.9 million; 2009 –$1,763.3 million; 2010 – $372.1 million; 2011 – $4,273.7 million; and

thereafter - $8,875.9 million. Restrictive provisions of several long-term debt agreements prevent the

Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of

subsidiaries. Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers

of assets, minimum shareholders’ equity, and maximum borrowings by the Company. As of

December 31, 2006, the Company was in compliance with all covenants and provisions of long-term

debt agreements. The junior subordinated debentures held by various trusts included in the Company’s

long-term debt that qualified as Tier 1 capital was $2,382.2 million and $1,883.3 million as of

December 31, 2006 and 2005, respectively. As currently defined by federal bank regulators, long-term

debt of $3,404.5 million and $3,712.2 million as of December 31, 2006 and 2005, respectively, qualified

as Tier 2 capital.

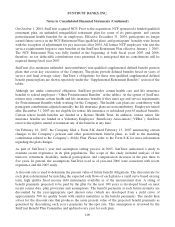

In connection with FIN 46(R), the Company does not consolidate certain wholly-owned trusts which

have been formed for the sole purpose of issuing trust preferred securities. The proceeds from the trust

preferred securities issuances were invested in junior subordinated debentures of the Parent Company

and Bank Parent Company. The obligations of these debentures constitute a full and unconditional

guarantee by the Parent Company and Bank Parent Company of the trust preferred securities.

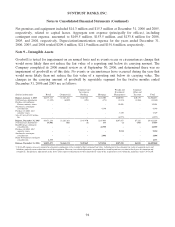

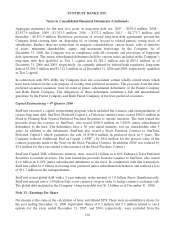

Capital Restructuring – 4th Quarter 2006

SunTrust executed a capital restructuring program which included the issuance and extinguishment of

certain long-term debt. SunTrust Preferred Capital I, a Delaware statutory trust, issued $500.0 million in

Fixed to Floating Rate Normal Preferred Purchase Securities to outside investors. The trust loaned the

proceeds from the issuance to SunTrust, who issued $500.0 million in 5.588% junior subordinated

debentures to the trust. The debentures have a 36 year initial maturity, but are remarketable after 5

years. In addition to the debentures, SunTrust also issued a Stock Purchase Contract to SunTrust

Preferred Capital I which guarantees the sale of $500.0 million in preferred stock in 5 years. The

Company reduced Additional Paid in Capital (“APIC”) by $6.0 million for the present value of the

contract payments made to the Trust on the Stock Purchase Contract. In addition APIC was reduced by

$3.4 million for the costs related to the issuance of the Stock Purchase Contract.

SunTrust Capital VIII, a Delaware statutory trust, issued $1 billion in 6.10% Enhanced Trust Preferred

Securities to outside investors. The trust loaned the proceeds from the issuance to SunTrust, who issued

$1.0 billion in 6.10% junior subordinated debentures to the trust. In conjunction with this transaction,

SunTrust called $1.0 billion in existing trust preferred junior subordinated debentures and realized a loss

of $11.7 million on the extinguishment.

SunTrust issued global debt with a 5 year maturity in the amount of 1.0 billion Euros. Simultaneously,

SunTrust entered into a 1.0 billion Euro cross currency swap in order to hedge currency exchange risk.

The global debt included in the Company’s long-term debt was $1.3 billion as of December 31, 2006.

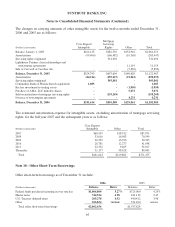

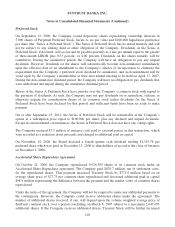

Note 13 - Earnings Per Share

Net income is the same in the calculation of basic and diluted EPS. There were no antidilutive shares for

the year ending December 31, 2006. Equivalent shares of 0.3 million and 5.3 million related to stock

options for the years ended December 31, 2005, and 2004, respectively, were excluded from the

101