SunTrust 2006 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

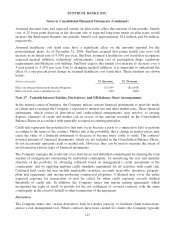

enters into transactions with dealers to offset its risk exposure. Derivatives entered into in a dealer

capacity and those that either do not qualify for, or for which the Company has elected not to apply,

hedge accounting are accounted for as free standing derivatives. As such, those derivatives are carried at

fair value on the Consolidated Balance Sheet, with changes in fair value recorded in noninterest income.

Derivatives designated in hedging transactions are accounted for in accordance with the provisions of

SFAS No. 133.

The Company’s derivatives are based on underlying risks primarily related to interest rates, equities,

foreign exchange rates or credit, and include swaps, options, and futures and forwards. Swaps are

contracts in which a series of net cash flows, based on a specific notional amount that is related to an

underlying risk, are exchanged over a prescribed period. Options, generally in the form of caps and

floors, are contracts that transfer, modify, or reduce an identified risk in exchange for the payment of a

premium when the contract is issued. Futures and forwards are contracts for the delayed delivery or net

settlement of an underlying, such as a security or interest rate index, in which the seller agrees to deliver

on a specified future date, either a specified instrument at a specified price or yield or the net cash

equivalent of an underlying.

Derivatives expose the Company to credit risk. If the counterparty fails to perform, the credit risk is

equal to the fair value gain of the derivative. The credit exposure for swaps and options is the

replacement cost of contracts that have become favorable to the Company. The credit risk inherent in

futures is the risk that the exchange party may default and, because futures contracts settle in cash daily,

the Company is exposed to minimal credit risk. The credit risk inherent in forwards arises from the

potential inability of counterparties to meet the terms of their contracts. The Company minimizes the

credit or repayment risk in derivative instruments by entering into transactions with high quality

counterparties that are reviewed periodically by the Company’s credit committee. The Company also

maintains a policy of requiring that all derivatives be governed by an International Swaps and

Derivatives Associations Master Agreement; depending on the nature of the derivative transactions,

bilateral collateral agreements may be required as well. When the Company has more than one

outstanding derivative transaction with a single counterparty, and there exists a legally enforceable

master netting agreement with the counterparty, the Company considers its exposure to the counterparty

to be the net market value of all positions with that counterparty if such net value is a liability to the

Company and zero if such net value is an asset to the Company. The net market position with a

particular counterparty represents a reasonable measure of credit risk when there is a legally enforceable

master netting agreement, including a legal right of offset of receivable and payable derivatives between

the Company and a counterparty.

Derivatives also expose the Company to market risk. Market risk is the adverse effect that a change in

interest rates, currency rates or implied volatility has on the value of a derivative. The Company

manages the market risk associated with its derivatives by establishing and monitoring limits on the

types and degree of risk that may be undertaken. The Company continually measures this risk by using a

value-at-risk methodology.

116