SunTrust 2006 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

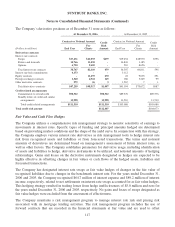

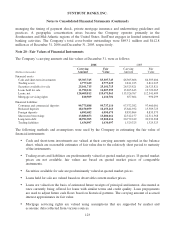

•Deposit liabilities with no defined maturity such as demand deposits, NOW/money market

accounts, and savings accounts have a fair value equal to the amount payable on demand at the

reporting date, i.e., their carrying amounts. Fair values for certificates of deposit are estimated

using a discounted cash flow calculation that applies current interest rates to a schedule of

aggregated expected maturities. The intangible value of long-term relationships with depositors

is not taken into account in estimating fair values.

•Fair values for foreign deposits, brokered deposits, short-term borrowings and long-term debt are

based on quoted market prices for similar instruments or estimated using discounted cash flow

analysis and the Company’s current incremental borrowing rates for similar types of instruments.

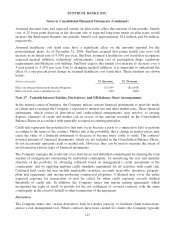

Note 21 - Contingencies

On August 25, 2006, the Company received notice from the Securities and Exchange Commission

(“SEC”) that the SEC had terminated its formal inquiry into matters concerning the restatement of

SunTrust’s financial statements for the first and second quarters of fiscal 2004 and related matters, and

that the Staff of the SEC recommended to the Commission that no enforcement action be taken against

the Company.

In addition, the Company and its subsidiaries are parties to numerous claims and lawsuits arising in the

course of their normal business activities, some of which involve claims for substantial amounts. The

Company’s experience has shown that the damages often alleged by plaintiffs or claimants are grossly

overstated, unsubstantiated by legal theory, and bear no relation to the ultimate award that a court might

grant. In addition, valid legal defenses, such as statutes of limitations, frequently result in judicial

findings of no liability by the Company. Because of these factors, we cannot provide a meaningful

estimate of the range of reasonably possible outcomes of claims in the aggregate or by individual claim.

However, it is the opinion of management that liabilities arising from these claims in excess of the

amounts currently accrued, if any, will not have a material impact to the Company’s financial condition

or results of operations.

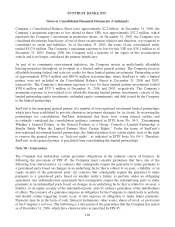

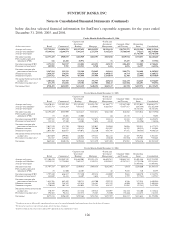

Note 22 - Business Segment Reporting

The Company uses a line of business management structure to measure business activities. The

Company has five primary lines of business: Retail, Commercial, Corporate and Investment Banking,

Wealth and Investment Management, and Mortgage.

The Retail line of business includes loans, deposits, and other fee based services for consumers and

business clients with less than $5 million in sales (up to $10 million in sales in larger metropolitan

markets). Clients are serviced through an extensive network of traditional and in store branches, ATMs,

the Internet and the telephone.

The Commercial line of business provides enterprises with a full array of financial products and services

including commercial lending, financial risk management, and treasury and payment solutions including

commercial card services. This line of business primarily serves business clients between $5 million and

$250 million in annual revenues and clients specializing in commercial real estate activities.

124