SunTrust 2006 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

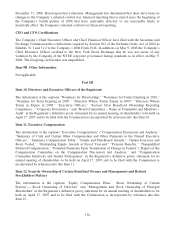

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

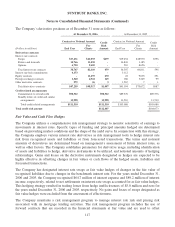

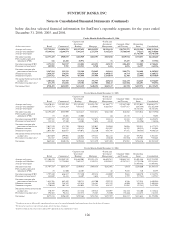

below disclose selected financial information for SunTrust’s reportable segments for the years ended

December 31, 2006, 2005, and 2004.

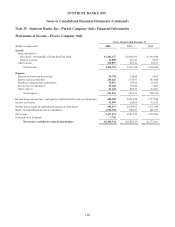

Twelve Months Ended December 31, 2006

(Dollars in thousands) Retail Commercial

Corporate and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate Other

and Treasury

Reconciling

Items Consolidated

Average total assets $37,795,826 $34,856,520 $23,967,653 $42,014,951 $8,936,418 $30,712,272 $2,031,506 $180,315,146

Average total liabilities 69,140,616 14,244,954 7,901,335 2,151,556 9,615,218 59,788,844 (74,117) 162,768,406

Average total equity - - - - - - 17,546,740 17,546,740

Net interest income $2,373,435 $900,519 $202,909 $603,393 $367,088 ($119,932) $333,053 $4,660,465

Fully taxable-equivalent

adjustment (FTE) 116 41,418 30,972 - 71 15,437 (48) 87,966

Net interest income (FTE)12,373,551 941,937 233,881 603,393 367,159 (104,495) 333,005 4,748,431

Provision for loan losses2105,985 9,701 113,933 8,748 3,696 4,076 16,397 262,536

Net interest income after

provision for loan losses 2,267,566 932,236 119,948 594,645 363,463 (108,571) 316,608 4,485,895

Noninterest income 1,050,187 279,059 670,036 379,424 1,098,855 16,714 (25,903) 3,468,372

Noninterest expense 2,133,912 645,506 457,464 597,694 1,036,864 32,380 (23,960) 4,879,860

Net income before provision for

income taxes 1,183,841 565,789 332,520 376,375 425,454 (124,237) 314,665 3,074,407

Provision for income taxes3433,370 132,890 119,381 127,983 158,127 (121,508) 106,693 956,936

Net income/(loss) $750,471 $432,899 $213,139 $248,392 $267,327 ($2,729) $207,972 $2,117,471

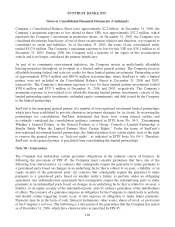

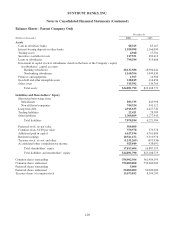

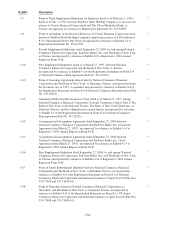

Twelve Months Ended December 31, 2005

Retail Commercial

Corporate and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate Other

and Treasury

Reconciling

Items Consolidated

Average total assets $36,870,411 $32,992,104 $21,259,491 $33,031,791 $8,565,773 $32,847,160 $2,522,041 $168,088,771

Average total liabilities 65,355,783 13,814,293 7,693,415 1,870,981 9,665,589 53,357,817 (195,389) 151,562,489

Average total equity - - - - - - 16,526,282 16,526,282

Net interest income $2,195,449 $858,909 $243,417 $547,671 $342,820 $16,686 $374,014 $4,578,966

Fully taxable-equivalent

adjustment (FTE) 83 38,201 22,005 - 64 15,138 1 75,492

Net interest income (FTE)12,195,532 897,110 265,422 547,671 342,884 31,824 374,015 4,654,458

Provision for loan losses2138,322 25,360 14,808 5,614 8,880 5,798 (21,896) 176,886

Net interest income after

provision for loan losses 2,057,210 871,750 250,614 542,057 334,004 26,026 395,911 4,477,572

Noninterest income 1,023,384 255,128 639,525 239,300 943,987 84,252 (30,532) 3,155,044

Noninterest expense 2,053,505 626,977 454,072 522,120 976,748 87,851 (30,544) 4,690,729

Net income before provision for

income taxes 1,027,089 499,901 436,067 259,237 301,243 22,427 395,923 2,941,887

Provision for income taxes3381,827 119,025 165,225 87,378 114,040 (52,554) 139,707 954,648

Net income $645,262 $380,876 $270,842 $171,859 $187,203 $74,981 $256,216 $1,987,239

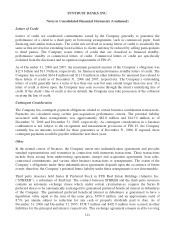

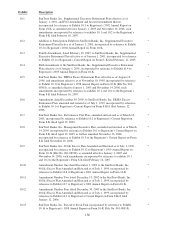

Twelve Months Ended December 31, 2004

Retail Commercial

Corporate and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate Other

and Treasury

Reconciling

Items Consolidated

Average total assets $27,308,870 $24,949,749 $18,668,903 $23,921,125 $6,658,742 $30,645,318 $1,601,586 $133,754,293

Average total liabilities 53,259,535 11,724,004 7,667,517 1,549,213 8,015,849 41,247,813 (1,179,120) 122,284,811

Average total equity - - - - - - 11,469,482 11,469,482

Net interest income $1,797,735 $655,387 $240,913 $489,314 $242,961 ($815) $259,660 $3,685,155

Fully taxable-equivalent

adjustment (FTE) 75 31,500 16,207 - 48 9,858 710 58,398

Net interest income (FTE)11,797,810 686,887 257,120 489,314 243,009 9,043 260,370 3,743,553

Provision for loan losses2142,049 24,438 16,407 3,614 3,780 2,797 (57,548) 135,537

Net interest income after

provision for loan losses 1,655,761 662,449 240,713 485,700 239,229 6,246 317,918 3,608,016

Noninterest income 834,680 236,389 632,618 116,363 821,155 (6,600) (30,159) 2,604,446

Noninterest expense 1,720,044 505,744 456,095 372,248 826,287 53,961 (37,341) 3,897,038

Net income before provision for

income taxes 770,397 393,094 417,236 229,815 234,097 (54,315) 325,100 2,315,424

Provision for income taxes3294,563 96,284 157,873 78,267 81,500 (78,442) 112,478 742,523

Net income $475,834 $296,810 $259,363 $151,548 $152,597 $24,127 $212,622 $1,572,901

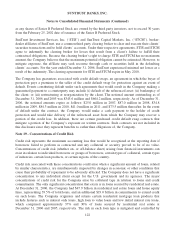

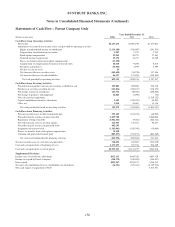

1Net interest income is fully taxable equivalent and is presented on a matched maturity funds transfer price basis for the lines of business.

2Provision for loan losses represents net charge-offs for the lines of business.

3Includes regular income tax provision and taxable-equivalent income adjustment reversal.

126