SunTrust 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

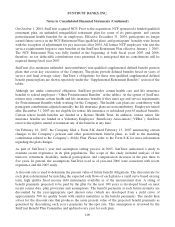

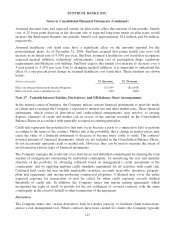

A rate of compensation growth is used to determine future benefit obligations for those plans whose

benefits vary by pay. Based on a 2005 study of recent SunTrust salary increase experience and

projections of real inflation, wage growth, and merit increases, SunTrust increased its compensation

increase assumption from 4.0% to 4.5% from year end 2004 to year end 2005. The assumption remained

unchanged for year-end 2006.

Actuarial gains and losses are created when actual experience deviates from assumptions. The actuarial

gains and losses for 2006 resulted from higher discount rates, offset by slightly higher than expected

retiree health care claims experience for the postretirement welfare plan, higher than expected salary

increases for the retirement plans, and participant data changes for all plans.

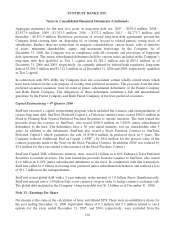

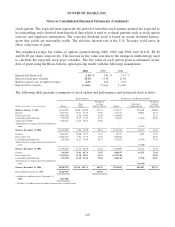

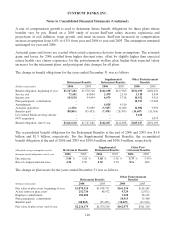

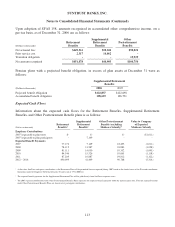

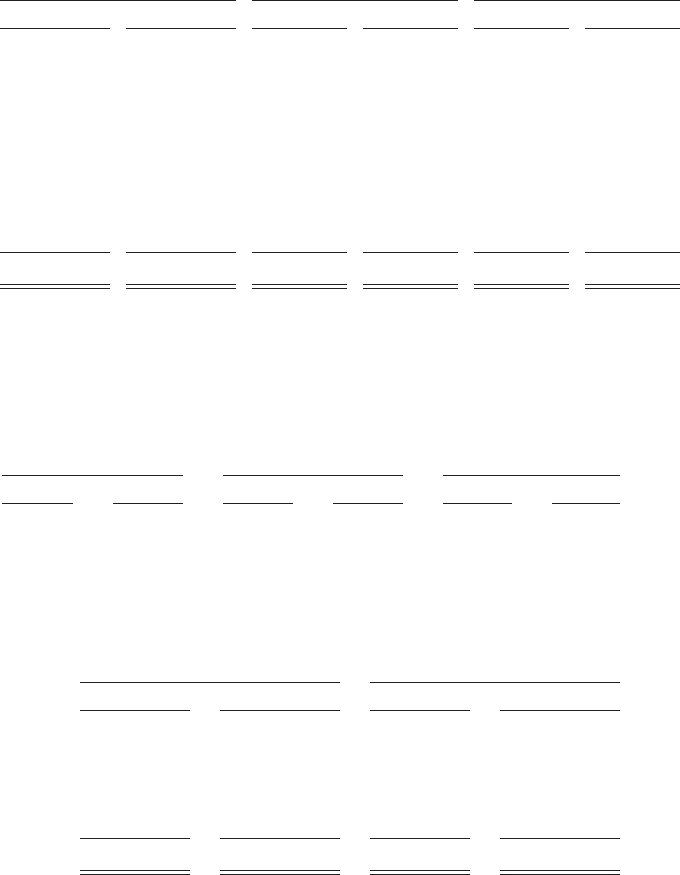

The change in benefit obligations for the years ended December 31 was as follows:

Retirement Benefits

Supplemental

Retirement Benefits

Other Postretirement

Benefits

(Dollars in thousands) 2006 2005 2006 2005 2006 2005

Benefit obligation, beginning of year $1,727,282 $1,570,728 $122,698 $127,969 $191,199 $182,291

Service cost 72,441 63,604 2,479 2,130 3,118 3,034

Interest cost 103,510 94,494 6,679 5,718 10,912 9,921

Plan participants’ contributions ----18,913 15,400

Amendments --4,028 4,510 --

Actuarial (gain)/loss (2,238) 93,889 (5,569) 11,080 16,982 9,390

Benefits paid (88,865) (95,433) (7,478) (28,709) (34,607) (31,916)

Less federal Medicare drug subsidy ----3,100 -

NCF acquisition -----3,079

Benefit obligation, end of year $1,812,130 $1,727,282 $122,837 $122,698 $209,617 $191,199

The accumulated benefit obligation for the Retirement Benefits at the end of 2006 and 2005 was $1.6

billion and $1.5 billion, respectively. For the Supplemental Retirement Benefits, the accumulated

benefit obligation at the end of 2006 and 2005 was $108.6 million and $106.8 million, respectively.

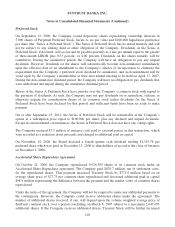

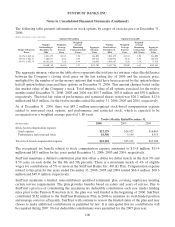

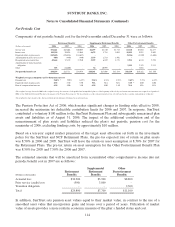

(Weighted average assumptions used to Retirement Benefits

Supplemental

Retirement Benefits

Other Post-

retirement Benefits

determine benefit obligations, end of year) 2006 2005 2006 2005 2006 2005

Discount rate 5.94 % 5.68 % 5.68 % 5.56 % 5.75 % 5.45%

Rate of compensation increase 4.50 4.50 4.50 4.50 N/A N/A

The change in plan assets for the years ended December 31 was as follows:

Retirement Benefits

Other Postretirement

Benefits

(Dollars in thousands) 2006 2005 2006 2005

Fair value of plan assets, beginning of year $1,870,310 $1,878,771 $161,310 $154,565

Actual return on plan assets 252,734 86,972 9,729 (2,871)

Employer contributions 182,000 -7,628 26,132

Plan participants’ contributions --18,913 15,400

Benefits paid (88,865) (95,433) (34,607) (31,916)

Fair value of plan assets, end of year $2,216,179 $1,870,310 $162,973 $161,310

110