SunTrust 2006 Annual Report Download - page 92

Download and view the complete annual report

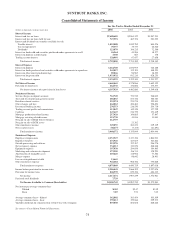

Please find page 92 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

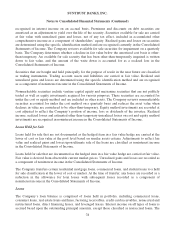

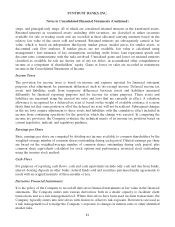

Notes to Consolidated Financial Statements (Continued)

Company typically classifies loans as nonaccrual when one of the following events occurs: (i) interest or

principal has been in default 90 days or more, unless the loan is well-secured and in the process of

collection; (ii) collection of recorded interest or principal is not anticipated; or (iii) income for the loan

is recognized on a cash basis due to the deterioration in the financial condition of the debtor. Consumer

and residential mortgage loans are typically placed on nonaccrual when payments have been in default

for 90 and 120 days or more, respectively.

When a loan is placed on nonaccrual, unpaid interest is reversed against interest income. Interest income

on nonaccrual loans, if recognized, is either recorded using the cash basis method of accounting or

recognized at the end of the loan after the principal has been reduced to zero, depending on the type of

loan. If and when borrowers demonstrate the ability to repay a loan in accordance with the contractual

terms of a loan classified as nonaccrual, the loan may be returned to accrual status. If a nonaccrual loan

is returned to accruing status, the accrued interest at the date the loan is placed on nonaccrual status, and

foregone interest during the nonaccrual period, are recorded as interest income only after all principal

has been collected for commercial loans. For consumer loans and residential mortgage loans, the

accrued interest at the date the loan is placed on nonaccrual status, and forgone interest during the

nonaccrual period, are recorded as interest income as of the date the loan no longer meets the applicable

criteria. (See “Allowance for Loan and Lease Losses” section of this Note for further discussion of

impaired loans.)

Fees and incremental direct costs associated with the loan origination and pricing process, as well as

premiums and discounts, are deferred and amortized as level yield adjustments over the respective loan

terms. Fees received for providing loan commitments that result in loans are deferred and then

recognized over the term of the loan as an adjustment of the yield.

Allowance for Loan and Lease Losses

The Company’s allowance for loan and lease losses is the amount considered adequate to absorb

probable losses within the portfolio based on management’s evaluation of the size and current risk

characteristics of the loan portfolio. Such evaluation considers prior loss experience, the risk rating

distribution of the portfolios, the impact of current internal and external influences on credit loss and the

levels of nonperforming loans. Specific allowances for loan and lease losses are established for large

impaired loans and leases on an individual basis. The specific allowance established for these loans and

leases is based on a thorough analysis of the most probable source of repayment, including the present

value of the loan’s expected future cash flows, the loan’s estimated market value, or the estimated fair

value of the underlying collateral. General allowances are established for loans and leases that can be

grouped into pools based on similar characteristics. In this process, general allowance factors are based

on an analysis of historical charge-off experience and expected losses given default derived from the

Company’s internal risk rating process. These factors are developed and applied to the portfolio in terms

of line of business and loan type. Adjustments are also made to the allowance for the pools after an

assessment of internal and external influences on credit quality that have not yet been reflected in the

historical loss or risk rating data. Unallocated allowances relate to inherent losses that are not otherwise

evaluated in the first two elements. The qualitative factors associated with unallocated allowances are

subjective and require a high degree of management judgment. These factors include the inherent

imprecisions in mathematical models and credit quality statistics, recent economic uncertainty, losses

incurred from recent events, and lagging or incomplete data.

79