SunTrust 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

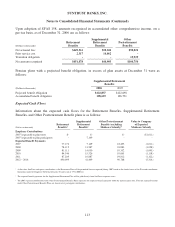

Notes to Consolidated Financial Statements (Continued)

as any shares of Series B Preferred Stock are owned by the third party investors, not to exceed 30 years

from the February 25, 2002 date of issuance of the Series B Preferred Stock.

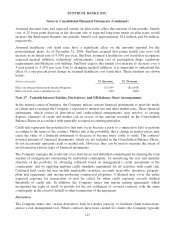

SunTrust Investment Services, Inc. (“STIS”) and SunTrust Capital Markets, Inc. (“STCM”), broker-

dealer affiliates of SunTrust, use a common third party clearing broker to clear and execute their clients’

securities transactions and to hold clients’ accounts. Under their respective agreements, STIS and STCM

agree to indemnify the clearing broker for losses that result from a client’s failure to fulfill their

contractual obligations. Because the clearing broker’s right to charge STIS and STCM has no maximum

amount, the Company believes that the maximum potential obligation cannot be estimated. However, to

mitigate exposure, the affiliate may seek recourse through cash or securities held in the defaulting

clients’ accounts. For the year ended December 31, 2006, SunTrust experienced minimal net losses as a

result of the indemnity. The clearing agreements for STIS and STCM expire in May 2010.

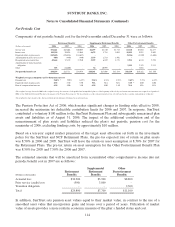

The Company has guarantees associated with credit default swaps, an agreement in which the buyer of

protection pays a premium to the seller of the credit default swap for protection against an event of

default. Events constituting default under such agreements that would result in the Company making a

guaranteed payment to a counterparty may include (i) default of the referenced asset; (ii) bankruptcy of

the client; or (iii) restructuring or reorganization by the client. The notional amount outstanding as of

December 31, 2006 and 2005 was $345.6 million and $664.2 million, respectively. As of December 31,

2006, the notional amounts expire as follows: $25.0 million in 2007, $87.0 million in 2008, $34.8

million in 2009, $84.3 million in 2010, $41.0 million in 2011, and $73.5 million thereafter. In the event

of default under the contract, the Company would make a cash payment to the holder of credit

protection and would take delivery of the referenced asset from which the Company may recover a

portion of the credit loss. In addition, there are certain purchased credit default swap contracts that

mitigate a portion of the Company’s exposure on written contracts. Such contracts are not included in

this disclosure since they represent benefits to, rather than obligations of, the Company.

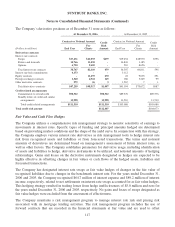

Note 19 - Concentrations of Credit Risk

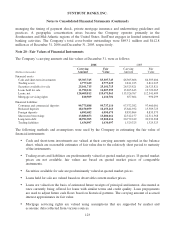

Credit risk represents the maximum accounting loss that would be recognized at the reporting date if

borrowers failed to perform as contracted and any collateral or security proved to be of no value.

Concentrations of credit risk (whether on- or off-balance sheet) arising from financial instruments can

exist in relation to individual borrowers or groups of borrowers, certain types of collateral, certain types

of industries, certain loan products, or certain regions of the country.

Credit risk associated with these concentrations could arise when a significant amount of loans, related

by similar characteristics, are simultaneously impacted by changes in economic or other conditions that

cause their probability of repayment to be adversely affected. The Company does not have a significant

concentration to any individual client except for the U.S. government and its agencies. The major

concentrations of credit risk for the Company arise by collateral type in relation to loans and credit

commitments. The only significant concentration that exists is in loans secured by residential real estate.

At December 31, 2006, the Company had $47.9 billion in residential real estate loans and home equity

lines, representing 39.5% of total loans, and an additional $19.0 billion in commitments to extend credit

on such loans. The Company originates and retains certain residential mortgage loan products that

include features such as interest only loans, high loan to value loans and low initial interest rate loans,

which comprised approximately 37% and 30% of loans secured by residential real estate at

December 31, 2006 and 2005, respectively. The risk in each loan type is mitigated and controlled by

122