SunTrust 2006 Annual Report Download - page 73

Download and view the complete annual report

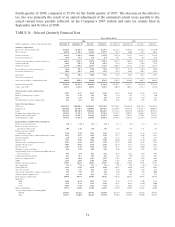

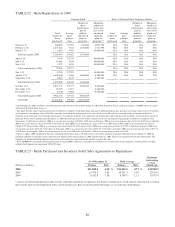

Please find page 73 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fully taxable-equivalent net interest income increased $397.7 million, or 22.1%. The NCF acquisition

contributed approximately $137 million of the increase. The remainder of the increase was attributable

to loan and deposit growth and widening deposit spreads due to deposit rate increases that have been

slower relative to market rate increases. Average loans increased $6.0 billion, or 24.7%, while average

deposits increased $12.1 billion, or 22.8%. The NCF acquisition was the primary driver of these

increases, contributing approximately $5 billion in loans and approximately $11 billion in deposits. The

remaining loan growth was driven primarily by equity lines and student lending while the remaining

deposit growth was driven by demand deposits (“DDA”), NOW accounts, money market accounts and

certificates of deposit.

Provision for loan losses, which represents net charge-offs for the lines of business, decreased $3.7

million, or 2.6%, primarily due to a decline in consumer indirect auto loans net charge-offs.

Noninterest income increased $188.7 million, or 22.6%. The addition of NCF contributed approximately

$133 million of this increase. The remaining increase was driven primarily by interchange income due

to increased debit and credit card transaction volumes.

Noninterest expense increased $333.5 million, or 19.4%. This increase was driven by the addition of

NCF and personnel expense due to merit increases and headcount increases driven by branch expansion.

Commercial

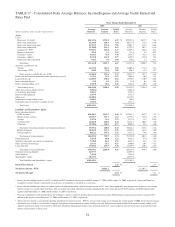

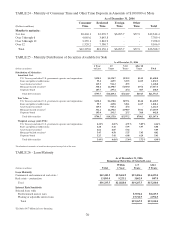

Commercial’s net income for the twelve months ended December 31, 2005 was $380.9 million, an

increase of $84.1 million, or 28.3%, compared to the same period in 2004. NCF accounted for

approximately $30 million of the increase. The remaining increase was due to improvement in net

interest income and higher noninterest income, partially offset by higher noninterest expense.

Fully taxable-equivalent net interest income increased $210.2 million or 30.6%. Net interest income

growth was driven by loan and deposit growth and higher deposit spreads. Average loans increased $7.0

billion, or 29.6%, and average deposits increased $2.0 billion, or 18.0%. NCF accounted for

approximately $114 million of the net interest income growth, approximately $5 billion of the loan

growth and approximately $1 billion of the deposit growth. The remaining loan growth was driven by

stronger demand for commercial and commercial real estate loans. The remaining deposit growth was

attributable to increased client liquidity.

Provision for loan losses, which represents net charge-offs for the lines of business, increased $.92

million when compared to the same period in 2004, despite approximately a $7 million increase from

NCF and a $3.2 million increase from Affordable Housing.

Noninterest income increased $18.7 million, or 7.9%. NCF accounted for approximately $5 million of

the increase. Affordable Housing contributed $6.7 million of the increase, driven by higher tax credits

from new properties and additional investments, as well as higher partnership revenue. The remaining

increase was due to increases in capital markets activities, loan fees, and deposit sweep income. Partially

offsetting these increases, was a decrease in service charges on deposits due to higher compensating

balances and increased client earnings credit rates.

Noninterest expense increased $121.2 million, or 24.0%. NCF accounted for approximately $64 million

of the increase. An additional $34.1 million of the increase was attributable to Affordable Housing

activities, primarily impairment and other charges related to Affordable Housing properties. The

remaining increase was primarily related to personnel expenses.

60