SunTrust 2006 Annual Report Download - page 69

Download and view the complete annual report

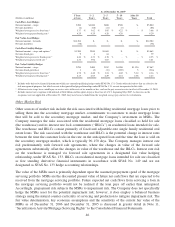

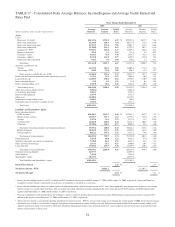

Please find page 69 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BUSINESS SEGMENTS RESULTS

Retail

Retail’s net income for the twelve months ended December 31, 2006 was $750.5 million, an increase of

$105.2 million, or 16.3%. The increase was primarily the result of loan and deposit growth, wider

deposit spreads, and lower provision for loan losses, partially offset by higher noninterest expense.

Fully taxable-equivalent net interest income increased $178.0 million, or 8.1%. The increase was

attributable to loan and deposit growth, a favorable change in the loan mix and wider deposit spreads.

Average loans increased $473.8 million, or 1.6%, primarily driven by growth in home equity products

offset by a decline in student loans due to sales and securitizations during 2006. Average deposits

increased $3.8 billion, or 5.8%, driven primarily by consumer time deposits. Deposit spreads widened

due to deposit rate increases that have been slower relative to market rate increases, as well as the

increasing value of lower cost deposits in a higher rate environment.

Provision for loan losses, which represents net charge-offs for the lines of business, decreased $32.3

million, or 23.4%, primarily due to a decline in consumer indirect auto net charge-offs.

Total noninterest income increased $26.8 million, or 2.6%. The increase was driven primarily by

interchange income due to increased volumes, as well as gains on student loan sales.

Total noninterest expense increased $80.4 million, or 3.9%. The increase was driven by increases in

interchange expense due to increased volume, as well as personnel and operations expense related to

investments in the branch distribution network and technology. Forty-four net new branches were added

during 2006.

Commercial

Commercial’s net income for the twelve months ended December 31, 2006 was $432.9 million, an

increase of $52.0 million, or 13.7%. The increase was primarily driven by net interest income and

noninterest income growth and lower provision for loan losses, partially offset by higher noninterest

expense.

Fully taxable-equivalent net interest income increased $44.8 million, or 5.0%. The increase was driven

by loan and deposit growth, as well as wider deposit spreads. Average loans increased $1.7 billion, or

5.5%, with the strongest growth in construction lending. Average deposits increased $378.5 million, or

2.8%, driven by an increase in institutional and government deposits and partially offset by decreases in

demand deposits and money market accounts. Deposit spreads increased due to the increasing value of

lower-cost deposits in a higher rate environment.

Provision for loan losses, which represents net charge-offs for the lines of business, decreased $15.7

million, or 61.7%. The decrease was driven primarily by lower net charge-offs in the Core Commercial

and the Real Estate Finance Group sub-lines of business.

Total noninterest income increased $23.9 million, or 9.4%. The increase resulted from higher

Affordable Housing revenues, deposit sweep income, as well as increased revenue from capital markets

and card products.

Total noninterest expense increased $18.5 million, or 3.0%. Increases in personnel and operations

expense were partially offset by a decrease in Affordable Housing expense.

56