SunTrust 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

without changing any other assumption. In reality, changes in one factor may result in changes in

another, which might magnify or counteract the sensitivities.

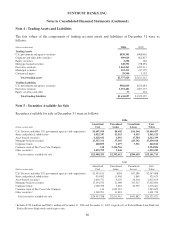

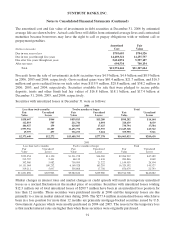

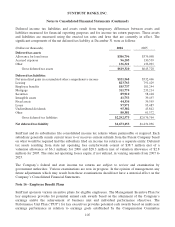

The following is the activity of mortgage servicing rights included in intangible assets in the

Consolidated Balance Sheets as of December 31.

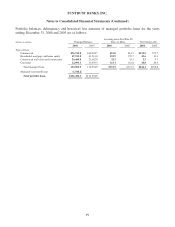

(Dollars in thousands) 2006 2005 2004

Balance at beginning of year $657,604 $482,392 $449,293

Amortization 1(195,627) (166,482) (168,127)

Servicing rights originated 503,801 341,694 196,118

NCF acquisition -- 5,108

Sale/securitization of mortgage servicing rights (155,269) --

Balance at end of year $810,509 $657,604 $482,392

1Included $72.3 million, $89.6 million, and $77.4 million for the years ended December 31, 2006, 2005, and 2004, respectively, on loans that have been

paid-in-full and loans that have been foreclosed.

No valuation allowances were required at December 31, 2006, 2005, and 2004 for the Company’s

mortgage servicing rights. As of December 31, 2006 and 2005, the total unpaid principal balance of

mortgage loans serviced was $130.0 billion and $105.6 billion, respectively. Included in these amounts

were $91.5 billion and $68.9 billion as of December 31, 2006 and 2005, respectively, of loans serviced

for third parties.

Other Securitizations

The Company sells and securitizes student loans, commercial loans, including commercial mortgage

loans, as well as debt securities. Retained interests in securitized assets, including debt securities, are

recorded as securities available for sale or trading assets at their allocated carrying amounts based on the

relative fair value at time of securitization. Retained interests are subsequently carried at fair value,

which, for subordinated and other residual interests for which there is no quoted market price, is

generally estimated based on the present value of expected cash flows, calculated using management’s

best estimates of key assumptions, including credit losses, loan repayment speeds and discount rates

commensurate with the risks involved. Gains or losses upon securitization as well as servicing fees and

collateral management fees are recorded in noninterest income.

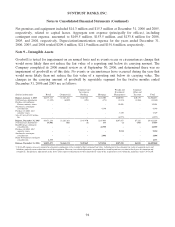

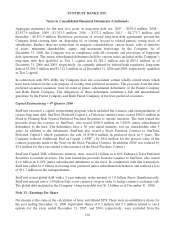

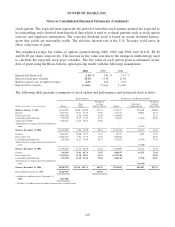

In 2006, the Company recognized net gains and fees related to the securitization of commercial and

student loans and debt securities of $47.9 million. Certain cash flows from the securitizations are as

follows for the twelve months ending December 31, 2006.

(Dollars in millions) Student Loans

Commercial

Loans

Debt

Securities

Proceeds from securitizations in 2006 $750.1 $1,546.3 $472.6

Collateral manager fees received - 2.2 -

Servicing fees received 0.7 - -

Other cash flows received on retained

interest - 0.9 -

97