SunTrust 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

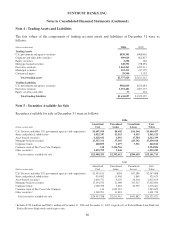

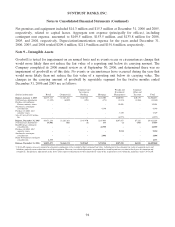

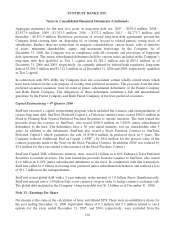

Note 7 - Allowance for Loan and Lease Losses

Activity in the allowance for loan and lease losses for the twelve months ended December 31 is

summarized in the table below:

(Dollars in thousands) 2006 2005 2004

Balance at beginning of year $1,028,128 $1,050,024 $941,922

Allowance from acquisitions, dispositions and other activity - net -- 173,844

Provision for loan losses 262,536 176,886 135,537

Loan charge-offs (356,569) (315,245) (316,081)

Loan recoveries 110,426 116,463 114,802

Balance at end of year $1,044,521 $1,028,128 $1,050,024

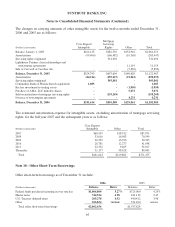

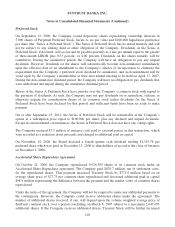

Note 8 - Premises and Equipment

Premises and equipment at December 31 were as follows:

(Dollars in thousands) Useful Life 2006 2005

Land Indefinite $482,386 $468,179

Buildings and improvements 2 - 40 years 1,481,222 1,484,335

Leasehold improvements 1 - 30 years 453,797 421,442

Furniture and equipment 1 - 20 years 1,278,801 1,160,456

Construction in progress 279,259 159,266

3,975,465 3,693,678

Less accumulated depreciation and amortization 1,998,053 1,839,151

Total premises and equipment $1,977,412 $1,854,527

The carrying amounts of premises and equipment subject to mortgage indebtedness (included in long-

term debt) were not significant at December 31, 2006 and 2005.

Various Company facilities are leased under both capital and noncancelable operating leases with initial

remaining terms in excess of one year. Minimum payments, by year and in aggregate, as of

December 31, 2006 were as follows:

(Dollars in thousands)

Operating

Leases

Capital

Leases

2007 $138,519 $2,337

2008 125,710 2,372

2009 111,454 2,384

2010 97,476 2,496

2011 75,566 2,544

Thereafter 375,040 30,359

Total minimum lease payments $923,765 42,492

Amounts representing interest 21,899

Present value of net minimum lease payments $20,593

93