SunTrust 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

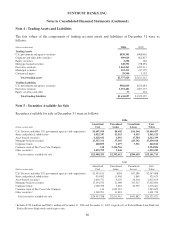

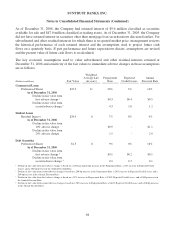

The average balances of short-term borrowings for the years ended December 31, 2006, 2005, and 2004

were $1.5 billion, $2.7 billion, and $1.7 billion, respectively, while the maximum amounts outstanding

at any month-end during the years ended December 31, 2006, 2005, and 2004 were $2.4 billion, $3.5

billion, and $4.0 billion, respectively.

Note 11 - Securitization Activity and Mortgage Servicing Rights

Mortgage-related Securitizations

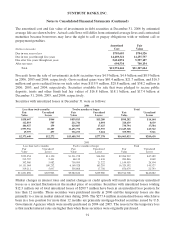

In May 2006, the Company sold residential mortgage loans in a securitization transaction in exchange

for net proceeds of $496.5 million and retained interests of $1.1 million in the form of interest only

strips and principal only strips. The Company continues to perform servicing for the underlying

mortgage loans. Servicing assets of approximately $9 million were recorded as a result of the

transaction. A pre-tax gain of $1.1 million was also recognized as a result of the transaction. The key

assumptions used in measuring the fair value of the retained interests at the time of the securitization are

current interest rates and prepayment speeds. Adverse changes in these key assumptions of 10% and

20% were analyzed, and the fair value sensitivity for each of these changes in aggregate totaled less than

$1 million. At December 31, 2006 and 2005, retained interests classified on the Consolidated Balance

Sheets as securities available for sale from mortgage loan securitizations were $209.3 million and

$288.4 million, respectively.

In March 2006, the Company securitized and sold $60.0 million of excess mortgage servicing rights in

exchange for net proceeds of $74.0 million and a retained interest of $10.4 million. A pre-tax gain of

$24.4 million was recognized as a result of the transaction. In December 2006, the Company sold its

retained interest in the securitization.

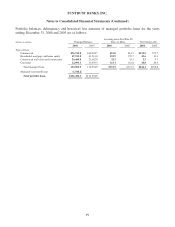

In addition to retained interests in securities, the Company may retain mortgage servicing rights from

the sale or securitization of residential mortgage loans. A summary of the key economic assumptions

used to measure total mortgage servicing rights and the sensitivity of the December 31, 2006 and 2005

fair values to immediate 10% and 20% adverse changes in those assumptions follows:

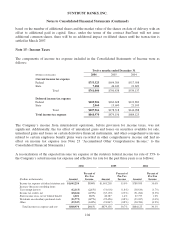

2006 2005

Prepayment rate (annual) 16.8% 13.3%

Weighted-average life (in years) 5.0 6.8

Discount rate 10.3% 10.0%

Weighted-average coupon 6.1 5.8

(Dollars in millions) 2006 2005

Fair value of retained mortgage servicing rights $1,110.7 $996.3

Prepayment rate assumption (annual) 16.8% 13.3%

Decline in fair value of 10% adverse change $44.5 $48.4

Decline in fair value of 20% adverse change 84.8 92.1

Residual cash flows discount rate (annual) 10.3% 10.0%

Decline in fair value of 10% adverse change $35.4 $32.7

Decline in fair value of 20% adverse change 68.6 63.4

The above sensitivities are hypothetical and should be used with caution. As the amounts indicate,

changes in fair value based on variations in assumptions generally cannot be extrapolated because the

relationship of the change in assumption to the change in fair value may not be linear. Also, in this table,

the effect of a variation in a particular assumption on the fair value of the retained interest is calculated

96