SunTrust 2006 Annual Report Download - page 60

Download and view the complete annual report

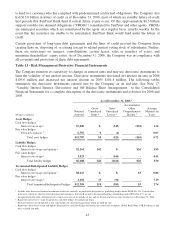

Please find page 60 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company is also subject to risk from changes in equity prices that arise from owning The Coca-

Cola Company common stock. SunTrust owns 48.2 million shares of common stock of The Coca-Cola

Company, which had a carrying value of $2.3 billion at December 31, 2006. A 10% decrease in share

price of The Coca-Cola Company common stock at December 31, 2006 would result in a decrease, net

of deferred taxes, of approximately $144 million in accumulated other comprehensive income.

OFF-BALANCE SHEET ARRANGEMENTS

In the normal course of business, the Company engages in financial transactions that, in accordance with

US GAAP, are either not recorded on the Company’s balance sheet or may be recorded on the

Company’s balance sheet at an amount that differs from the full contract or notional amount of the

transaction. These transactions are structured to meet the financial needs of clients, manage the

Company’s credit, market or liquidity risks, diversify funding sources, or optimize capital.

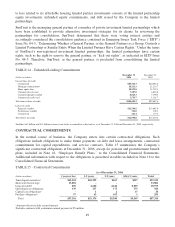

As a financial services provider, the Company routinely enters into commitments to extend credit,

including, but not limited to, loan commitments, financial and performance standby letters of credit and

financial guarantees. While these contractual obligations could potentially result in material current or

future effects on financial condition, results of operations, liquidity, capital expenditures, capital resources,

or significant components of revenues or expenses, based on historical experience, a significant portion of

commitments to extend credit expire without being drawn upon. Such commitments are subject to the

same credit policies and approval processes accorded to loans made by the Company. See Table 14,

Unfunded Lending Commitments, for details on unfunded lending commitments.

The Company has undertaken certain guarantee obligations in the ordinary course of business. In

following the provisions of FASB Interpretation (“FIN”) No. 45, “Guarantors Accounting and

Disclosure Requirements for Guarantees,” (“FIN 45”) the Company must consider guarantees that have

any of the following four characteristics (i) contracts that contingently require the guarantor to make

payments to a guaranteed party based on changes in an underlying factor that is related to an asset, a

liability, or an equity security of the guaranteed party; (ii) contracts that contingently require the

guarantor to make payments to a guaranteed party based on another entity’s failure to perform under an

obligating agreement; (iii) indemnification agreements that contingently require the indemnifying party

to make payments to an indemnified party based on changes in an underlying factor that is related to an

asset, a liability, or an equity security of the indemnified party; and (iv) indirect guarantees of the

indebtedness of others. The issuance of these guarantees imposes an obligation to stand ready to

perform, and should certain triggering events occur, it also imposes an obligation for the Company to

make future payments. Note 18, “Guarantees,” to the Consolidated Financial Statements includes details

regarding the Company’s guarantee obligations under FIN 45.

In the normal course of business, the Company utilizes various derivative and credit-related financial

instruments to meet the needs of clients and to manage the Company’s exposure to interest rate and

other market risks. These financial instruments involve, to varying degrees, elements of credit and

market risk in excess of the amount recorded on the balance sheet in accordance with US GAAP.

SunTrust manages the credit risk of its derivatives by (i) limiting the total amount of arrangements

outstanding by an individual counterparty; (ii) monitoring the size and maturity structure of the

portfolio; (iii) obtaining collateral based on management’s credit assessment of the counterparty;

(iv) applying uniform credit standards maintained for all activities with credit risk; and (v) entering into

transactions with high quality counterparties that are periodically reviewed by the Company’s Credit

Management Committee. The Company manages the market risk of its derivatives by establishing and

monitoring limits on the types and degree of risk that may be undertaken. The Company continually

measures market risk by using a value-at-risk methodology. Note 17, “Variable Interest Entities,

Derivatives, and Off-Balance Sheet Arrangements,” to the Consolidated Financial Statements includes

47