SunTrust 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This narrative will assist readers in their analysis of the accompanying consolidated financial statements

and supplemental financial information of the Company. It should be read in conjunction with the

Consolidated Financial Statements and Notes on pages 73 through 130.

Effective October 1, 2004, National Commerce Financial Corporation (“NCF”) merged with SunTrust.

The results of operations for NCF were included with SunTrust’s results beginning October 1, 2004.

Prior periods do not reflect the impact of the merger.

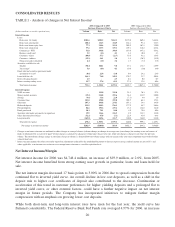

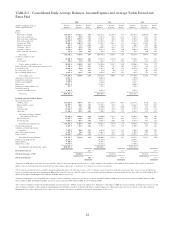

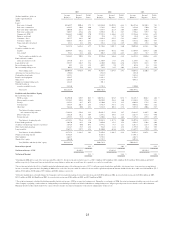

In Management’s Discussion and Analysis, net interest income, net interest margin and the efficiency

ratio are presented on a fully taxable-equivalent (“FTE”) basis and the ratios are presented on an

annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and

investments. The Company believes this measure to be the preferred industry measurement of net

interest income and it enhances comparability of net interest income arising from taxable and

tax-exempt sources. The Company also presents diluted earnings per common share excluding merger

expense and an efficiency ratio excluding merger expense that exclude merger charges related to the

NCF acquisition. The Company believes the exclusion of the merger charges, which represent

incremental costs to integrate NCF’s operations, is more reflective of normalized operations.

Additionally, the Company presents a return on average realized common shareholders’ equity, as well

as a return on average common shareholders’ equity (“ROE”). The Company also presents a return on

average assets less net unrealized securities gains/losses and a return on average total assets (“ROA”).

The return on average realized common shareholders’ equity and return on average assets less net

unrealized securities gains/losses exclude realized securities gains and losses, The Coca-Cola Company

dividend, and net unrealized securities gains. Due to its ownership of approximately 48 million shares of

common stock of The Coca-Cola Company, resulting in an unrealized net gain of $2.3 billion as of

December 31, 2006, the Company believes ROA and ROE excluding these impacts from the Company’s

securities portfolio is the more comparative performance measure when being evaluated against other

companies. SunTrust presents a tangible efficiency ratio and a tangible equity to tangible assets ratio

which exclude the cost of and the other effects of intangible assets resulting from merger and acquisition

(“M&A”) activity. The Company believes these measures are useful to investors because, by removing

the effect of intangible asset costs and merger and acquisition activity (the level of which may vary from

company to company), it allows investors to more easily compare the Company’s efficiency and capital

adequacy to other companies in the industry. The measures are utilized by management to assess the

efficiency of the Company and its lines of business as well as the capital adequacy of the Company. The

Company provides reconcilements on pages 67 and 68 for all non-US GAAP measures. Certain

reclassifications may be made to prior period financial statements and related information to conform

them to the 2006 presentation.

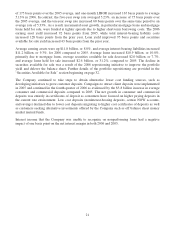

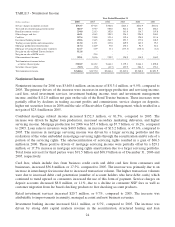

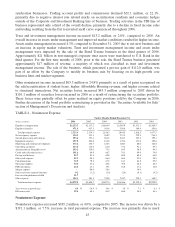

SunTrust reported net income available to common shareholders of $2,109.7 million, or $5.82 per

diluted common share for the year ended December 31, 2006. For the fourth quarter of 2006, SunTrust

reported net income available to common shareholders of $498.6 million or $1.39 per diluted common

share. These results have been revised from the earnings results the Company reported in its January 19,

2007 earnings release in which the Company reported net income available to common shareholders of

$2,134.8 million, or $5.88 per diluted common share for the year ended December 31, 2006 and net

income available to common shareholders of $523.6 million, or $1.46 per diluted common share for the

fourth quarter ended December 31, 2006. The reduction in earnings relates to a $40 million increase in

the provision for loan losses associated with the previously disclosed large commercial credit.

Subsequent to year end, the Company continued to work with the borrower associated with this large

commercial credit to identify all possible sources of repayment. As of December 31, 2006 and at the

17