SunTrust 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

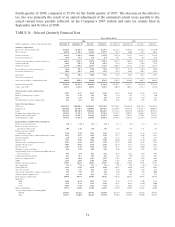

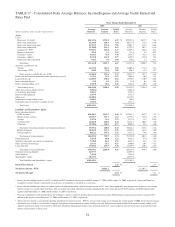

BUSINESS SEGMENTS

The Company has five primary lines of business (“LOBs”): Retail, Commercial, Corporate and

Investment Banking (“CIB”), Wealth and Investment Management, and Mortgage. In this section, the

Company discusses the performance and financial results of its business segments. For more financial

details on business segment disclosures, please see Note 22 – “Business Segment Reporting” to the

Consolidated Financial Statements.

Retail

The Retail line of business includes loans, deposits, and other fee-based services for consumers and

business clients with less than $5 million in sales (up to $10 million in sales in larger metropolitan

markets). Retail serves clients through an extensive network of traditional and in-store branches, ATMs,

the Internet (www.suntrust.com) and the telephone (1-800-SUNTRUST). In addition to serving the

retail market, the Retail line of business serves as an entry point for other lines of business. When client

needs change and expand, Retail refers clients to SunTrust’s Wealth and Investment Management,

Mortgage and Commercial lines of business.

Commercial

The Commercial line of business provides enterprises with a full array of financial products and services

including commercial lending, financial risk management, and treasury and payment solutions including

commercial card services. The primary client segments served by this line of business include

“Diversified Commercial” ($5 million to $50 million in annual revenue), “Middle Market” ($50 million

to $250 million in annual revenue), “Commercial Real Estate” (entities that specialize in commercial

real estate activities), and “Government/Not-for-Profit” entities. Also included in this segment are

specialty groups that operate both inside and outside of the SunTrust footprint, such as Premium

Assignment Corporation, which provides insurance premium financing, and Affordable Housing Group,

which manages community development projects that generate tax credits.

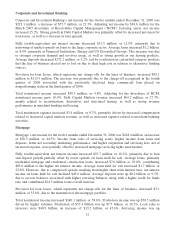

Corporate and Investment Banking

CIB serves issuer clients in the middle and large corporate markets. In addition to a large diversified

client base, CIB is focused on these key industry sectors: business services, consumer and retail,

financial services and technology, energy and healthcare. CIB provides an extensive range of investment

banking products and services, including mergers and acquisitions advice, capital raising in debt and

equity markets, financial risk management, asset securitization and market making in cash securities and

derivative instruments. These investment banking products and services are provided to CIB’s issuer

clients, Commercial clients and Wealth and Investment Management clients. CIB also offers traditional

lending, leasing, treasury management services and institutional investment management to its clients.

In addition, CIB serves investor clients through proprietary product flow in fixed income and equity

markets, secondary trading capabilities and equity research.

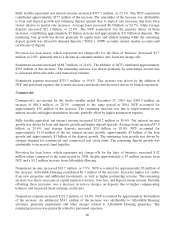

Mortgage

The Mortgage line of business offers residential mortgage products nationally through its retail, broker

and correspondent channels. These products are either sold in the secondary market primarily with

servicing rights retained or held as whole loans in the Company’s residential loan portfolio. The line of

business services loans for its own residential mortgage portfolio as well as for others. Additionally, the

line of business generates revenue through its tax service subsidiary (ValuTree Real Estate Services,

LLC) and its captive reinsurance subsidiary (Cherokee Insurance Company).

53