SunTrust 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

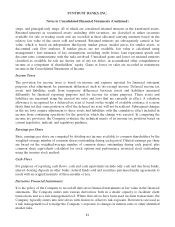

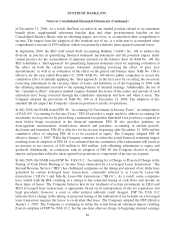

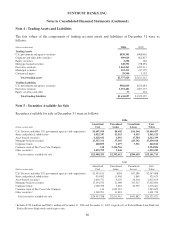

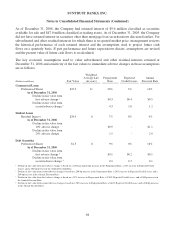

Note 4 - Trading Assets and Liabilities

The fair values of the components of trading account assets and liabilities at December 31 were as

follows:

(Dollars in thousands) 2006 2005

Trading Assets

U.S. government and agency securities $838,301 $468,056

Corporate and other debt securities 409,029 662,827

Equity securities 2,254 366

Mortgage-backed securities 140,531 278,294

Derivative contracts 1,064,263 1,059,311

Municipal securities 293,311 337,179

Commercial paper 29,940 5,192

Total trading assets $2,777,629 $2,811,225

Trading Liabilities

U.S. government and agency securities $382,819 $522,084

Derivative contracts 1,251,201 1,007,137

Equity securities and other 77 104

Total trading liabilities $1,634,097 $1,529,325

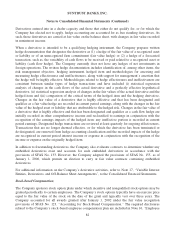

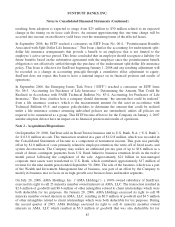

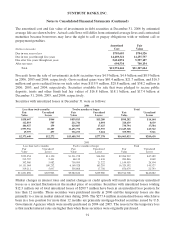

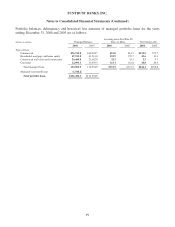

Note 5 - Securities Available for Sale

Securities available for sale at December 31 were as follows:

2006

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and other U.S. government agencies and corporations $1,607,999 $8,602 $16,144 $1,600,457

States and political subdivisions 1,032,247 13,515 4,639 1,041,123

Asset-backed securities 1,128,032 1,891 17,584 1,112,339

Mortgage-backed securities 17,337,311 37,365 243,762 17,130,914

Corporate bonds 468,855 1,477 7,521 462,811

Common stock of The Coca-Cola Company 110 2,324,716 - 2,324,826

Other securities11,423,799 5,446 - 1,429,245

Total securities available for sale $22,998,353 $2,393,012 $289,650 $25,101,715

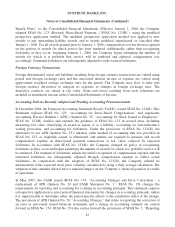

2005

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and other U.S. government agencies and corporations $2,593,813 $584 $47,389 $2,547,008

States and political subdivisions 914,082 15,460 3,869 925,673

Asset-backed securities 1,630,751 8,207 26,304 1,612,654

Mortgage-backed securities 17,354,552 11,669 343,527 17,022,694

Corporate bonds 1,090,559 2,665 22,793 1,070,431

Common stock of The Coca-Cola Company 110 1,945,512 - 1,945,622

Other securities11,369,921 31,818 - 1,401,739

Total securities available for sale $24,953,788 $2,015,915 $443,882 $26,525,821

1Includes $729.4 million and $860.1 million at December 31, 2006 and December 31, 2005, respectively, of Federal Home Loan Bank and

Federal Reserve Bank stock stated at par value.

90