SunTrust 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

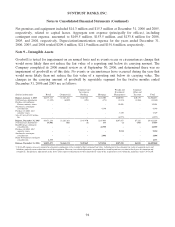

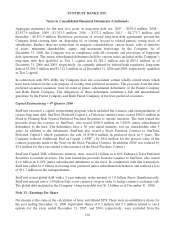

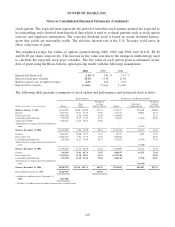

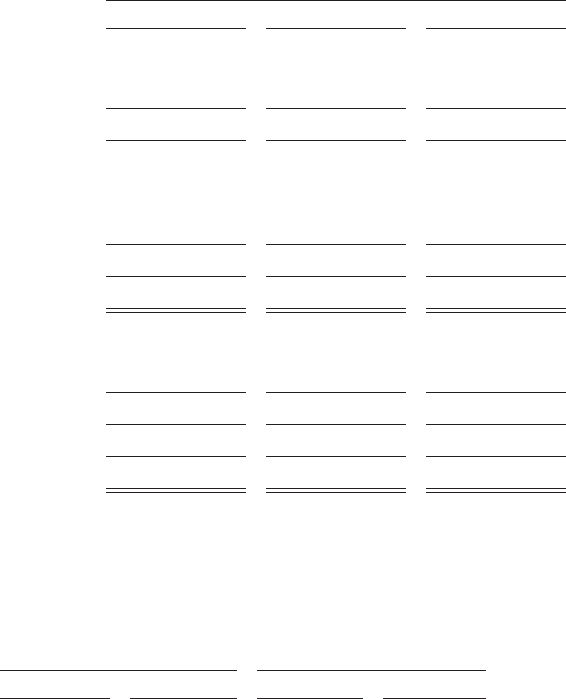

computations of diluted EPS because they would have been antidilutive. A reconciliation of the

difference between average basic common shares outstanding and average diluted common shares

outstanding for the twelve months ended December 31, 2006, 2005, and 2004 is included in the

following table:

(In thousands, except per share data)

Twelve Months Ended December 31

2006 2005 2004

Diluted

Net income $2,117,471 $1,987,239 $1,572,901

Preferred stock dividends 7,729 --

Net income available to common shareholders $2,109,742 $1,987,239 $1,572,901

Average basic common shares 359,413 359,066 299,375

Effect of dilutive securities:

Stock options 2,261 2,723 2,154

Performance and restricted stock 1,128 1,665 1,780

Average diluted common shares 362,802 363,454 303,309

Earnings per average common share - diluted $5.82 $5.47 $5.19

Basic

Net income $2,117,471 $1,987,239 $1,572,901

Preferred stock dividends 7,729 --

Net income available to common shareholders $2,109,742 $1,987,239 $1,572,901

Average basic common shares 359,413 359,066 299,375

Earnings per average common share - basic $5.87 $5.53 $5.25

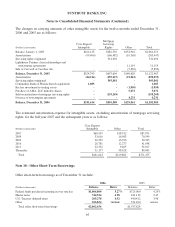

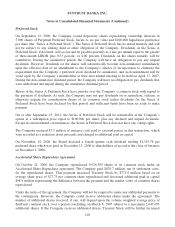

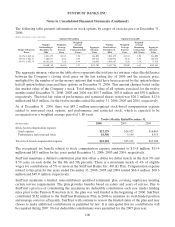

Note 14 - Capital

The Company is subject to various regulatory capital requirements which involve quantitative measures

of the Company’s assets.

(Dollars in millions)

2006 2005

Amount Ratio Amount Ratio

SunTrust Banks, Inc.

Tier 1 capital $12,525 7.72% $11,080 7.01%

Total capital 18,025 11.11 16,714 10.57

Tier 1 leverage 7.23 6.65

SunTrust Bank

Tier 1 capital 12,832 7.97 11,715 7.49

Total capital 17,454 10.85 16,483 10.54

Tier 1 leverage 7.35 7.04

Substantially all of the Company’s retained earnings are undistributed earnings of the Bank, which are

restricted by various regulations administered by federal and state bank regulatory authorities. Retained

earnings of the Bank available for payment of cash dividends to the Bank Parent Company under these

regulations totaled approximately $1.8 billion and $854 million at December 31, 2006 and 2005,

respectively. The Company also has amounts of cash reserves required by the Federal Reserve. As of

December 31, 2006 and 2005, these reserve requirements totaled $901.2 million and $863.6 million,

respectively.

102