SunTrust 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

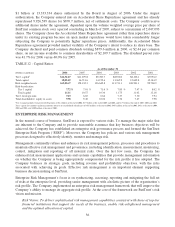

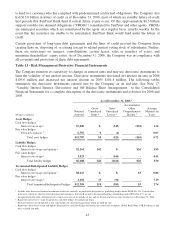

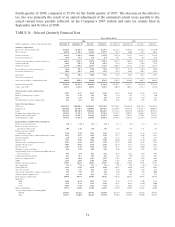

As of December 31, 2005 1

(Dollars in millions)

1 Year

or Less

1-2

Years

2-5

Years

5-10

Years

After 10

Years Total

Cash Flow Asset Hedges

Notional amount - swaps $300 $4,400 $600 $500 $- $5,800

Net unrealized loss (4) (68) (11) (5) - (88)

Weighted average receive fixed rate 23.17 % 3.62 % 3.95 % 4.22 % - % 3.68 %

Weighted average pay floating rate 24.29 4.29 4.29 4.29 - 4.29

Fair Value Asset Hedges

Notional amount - forwards $14,384 $- $- $- $- $14,384

Net unrealized loss (78) - - - - (78)

Cash Flow Liability Hedges

Notional amount - swaps and options 3$1,500 $500 $3,065 $- $- $5,065

Net unrealized gain 9 6 64 - - 79

Weighted average receive floating rate 24.46 % 4.33 % 4.30 % - % - % 4.35 %

Weighted average pay fixed rate 22.31 3.94 3.87 - - 3.41

Fair Value Liability Hedges

Notional amount - swaps $250 $400 $767 $4,900 $1,150 $7,467

Net unrealized gain/(loss) 1 (2) (31) (189) 5 (216)

Weighted average receive fixed rate 24.78 % 4.48 % 3.24 % 4.02 % 5.14 % 4.16 %

Weighted average pay floating rate 24.15 4.05 4.29 4.21 4.38 4.23

1Includes only derivative financial instruments which are currently qualifying hedges under SFAS No. 133. Certain other derivatives that are effective for

risk management purposes, but which are not in designated hedging relationships under SFAS No. 133, are not incorporated in this table.

2All interest rate swaps have variable pay or receive rates with resets of six months or less, and are the pay or receive rates in effect at December 31, 2005.

3Includes interest rate swaptions with notional of $0.4 billion and the option to pay a fixed rate of 4.31% beginning May 2007. As the rates on the

swaptions were not applicable at December 31, 2005, they have been excluded from the weighted average pay and receive calculations.

Other Market Risk

Other sources of market risk include the risk associated with holding residential mortgage loans prior to

selling them into the secondary mortgage market, commitments to customers to make mortgage loans

that will be sold to the secondary mortgage market, and the Company’s investment in MSRs. The

Company manages the risks associated with the residential mortgage loans classified as held for sale

(the warehouse) and its interest rate lock commitments (“IRLCs”) on residential loans intended for sale.

The warehouse and IRLCs consist primarily of fixed and adjustable-rate single family residential real

estate loans. The risk associated with the warehouse and IRLCs is the potential change in interest rates

between the time the customer locks in the rate on the anticipated loan and the time the loan is sold on

the secondary mortgage market, which is typically 90-150 days. The Company manages interest rate

risk predominately with forward sale agreements, where the changes in value of the forward sale

agreements substantially offset the changes in value of the warehouse and the IRLCs. Interest rate risk

on the warehouse is managed via forward sale agreements in a designated fair value hedging

relationship, under SFAS No. 133. IRLCs on residential mortgage loans intended for sale are classified

as free standing derivative financial instruments in accordance with SFAS No. 149 and are not

designated as SFAS No. 133 hedge accounting relationships.

The value of the MSRs asset is primarily dependent upon the assumed prepayment speed of the mortgage

servicing portfolio. MSRs are the discounted present value of future net cash flows that are expected to be

received from the mortgage servicing portfolio. Future expected net cash flows from servicing a loan in

the mortgage servicing portfolio would not be realized if the loan pays off earlier than anticipated.

Accordingly, prepayment risk subjects the MSRs to impairment risk. The Company does not specifically

hedge the MSRs asset for the potential impairment risk; however, it does employ a balanced business

strategy using the natural counter-cyclicality of servicing and production to mitigate impairment risk. The

fair value determination, key economic assumptions and the sensitivity of the current fair value of the

MSRs as of December 31, 2006 and December 31, 2005 is discussed in greater detail in Note 11,

“Securitization Activity/Mortgage Servicing Rights” to the Consolidated Financial Statements.

46