SunTrust 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

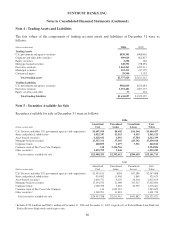

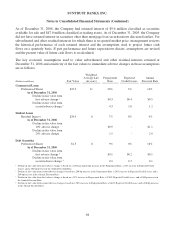

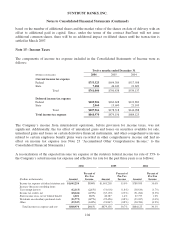

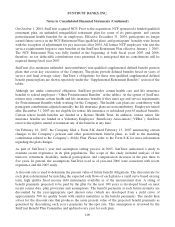

Note 12 - Long-Term Debt

Long term debt at December 31 consisted of the following:

(Dollars in thousands) 2006 2005

Parent Company Only

Senior

Floating rate notes due 2007 based on three month LIBOR + .08% $100,000 $100,000

5.05% notes due 2007 299,319 300,445

3.625% notes due 2007 249,884 249,759

6.25% notes due 2008 285,884 283,089

4.00% notes due 2008 349,636 349,461

4.25% notes due 2009 299,298 299,078

Floating rate notes due 2019 based on three month LIBOR + .15% 50,563 50,563

6.00% notes due 2028 221,657 221,603

Other -13,859

Total senior debt - Parent 1,856,241 1,867,857

Subordinated

7.375% notes due 2006 -199,940

7.75% notes due 2010 287,473 286,962

6.00% notes due 2026 199,897 199,878

Total subordinated debt - Parent 487,370 686,780

Junior Subordinated

7.90% notes due 20271250,000 249,978

Floating rate notes due 2027 based on three month LIBOR + .67%1349,731 349,662

Floating rate notes due 2027 based on three month LIBOR + .98%134,029 34,029

Floating rate notes due 2028 based on three month LIBOR + .65%1249,729 249,599

7.125% notes due 20311,2 -300,000

7.05% notes due 20311,2 -300,000

7.70% notes due 20311,2 -200,000

5.588% notes due 20421500,000 -

6.10% notes due 20361999,700 -

Total junior subordinated debt - Parent 2,383,189 1,683,268

Total Parent Company (excluding intercompany of $189,835 in 2006 and 2005) 4,726,800 4,237,905

Subsidiaries

Senior

Floating rate notes due 2006 based on three month LIBOR -1,000,000

2.125% notes due 2006 -150,000

2.50% notes due 2006 -399,976

Floating rate notes due 2008 based on three month LIBOR + .08% 500,000 500,000

Floating rate notes due 2009 based on three month LIBOR + .10% 400,000 400,000

4.55% notes due 2009 199,912 199,871

Equity linked notes due 2009-2037 68,669 32,856

Floating rate euro notes due 2011 based on three month EURIBOR + .11% 1,319,000 -

Floating rate notes due 2018 based on six month LIBOR -283,769

Capital lease obligations 20,593 20,994

FHLB advances (2006 and 2005: 0.00 - 8.79%) 7,738,092 9,027,134

Direct finance lease obligations 254,092 267,693

Other 395,370 402,187

Total senior debt - subsidaries 10,895,728 12,684,480

Subordinated

7.25% notes due 2006 -249,910

6.90% notes due 2007 98,705 97,010

6.375% notes due 2011 959,523 961,984

5.00% notes due 2015 530,760 538,938

Floating rate notes due 2015 based on three month LIBOR + .30% 200,000 200,000

Floating rate notes due 2015 based on three month LIBOR + .29% 300,000 300,000

5.45% notes due 2017 496,229 506,922

5.20% notes due 2017 342,897 349,466

6.50% notes due 2018 140,478 140,565

5.40% notes due 2020 301,785 312,069

Total subordinated debt - subsidaries 3,370,377 3,656,864

Junior Subordinated

8.16% notes due 20261,2 -200,000

Total junior subordinated debt - subsidaries -200,000

Total subsidiaries 14,266,105 16,541,344

Total long-term debt $18,992,905 $20,779,249

1Notes payable to trusts formed to issue Trust Preferred Securities totaled $2.4 billion and $1.9 billion at December 31, 2006 and 2005, respectively.

2Debt was extinguished in 2006 prior to the contractual repayment date. The Company recognized a net loss of $11.7 million as a result of the prepayment.

100