SunTrust 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.time of the 2006 earnings release, the Company had recorded a specific reserve which reflected

management’s best estimate of the expected loss based on information available at that time. In

February 2007, certain events occurred which resulted in a reduction of management’s estimate of the

net realizable amount of the loan. On February 23, 2007, the borrower signed a definitive agreement to

sell the majority of its assets, primarily customer contracts, to an unrelated third party at a value that was

less than previously estimated due in large part to a reduction in the borrower’s revenues after

December 31, 2006. As a result of the sale of the majority of the borrower’s assets, the large commercial

credit was partially repaid and the remainder of the Company’s exposure to this borrower was charged-

off. This resulted in an additional $40 million in provision for loan losses and a $68.8 million charge-

off.

SunTrust provided the financing to the purchaser. The Company believes the purchaser is financially

stable, and the new financing reflects market terms and conditions. The terms of the definitive sale

agreement include a component of contingent consideration of approximately $31 million, based on the

future performance of the purchased customer contracts. The performance period ends during the third

quarter of 2007. The contingent portion of the purchase was structured under a separate note. Since the

ultimate amount of repayment on this note is based on the future performance of the purchased customer

contracts, the note is classified as non accrual and the Company recorded a specific reserve based on the

estimated amount of consideration to be received. Nonperforming loans declined $130.5 million as a

result of the definitive agreement and new financing.

Management evaluated these events and determined that in accordance with generally accepted

accounting principles that it was necessary to reflect these revisions to the estimated net realizable

amount of the loan in its 2006 financial statements since these subsequent events occurred prior to the

filing of the Company’s 2006 Annual Report on Form 10-K. The revision to management’s estimate

subsequent to year end does not constitute a control deficiency. Rather, it is a reflection of the extremely

fluid nature of the workout activities associated with this large commercial credit and specific events

which took place subsequent to year end. All of the financial information included in the Company’s

2006 Annual Report on Form 10-K has been updated to reflect these revisions.

INTRODUCTION

SunTrust is headquartered in Atlanta, Georgia, and operates primarily within Florida, Georgia,

Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. Within

the geographic footprint, SunTrust strategically operates under five business segments. These business

segments are: Retail, Commercial, Corporate and Investment Banking (“CIB”), Wealth and Investment

Management, and Mortgage.

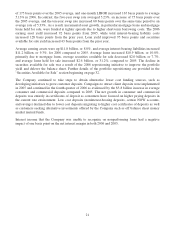

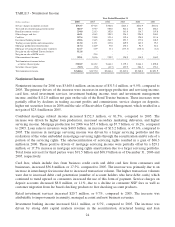

Despite a challenging operating environment in 2006, which included fierce deposit competition and a

prolonged flat to inverted yield curve, SunTrust was able to grow diluted earnings per common share by

6.4% over 2005. Loans, deposits and our overall customer base continued to grow in 2006, which

reflects our intense focus on sales and client service. As the year progressed and market conditions

became increasingly difficult, we were able to overcome the negative impact the yield curve had on net

interest income with strong fee income growth and by ratcheting up expense control. The Company also

instituted an efficiency and productivity program in the second half of 2006 which we expect to yield

significant benefits over the next several years. The efficiency and productivity initiatives, coupled with

our sales and service focus and strong credit culture, provide momentum going into 2007 and beyond.

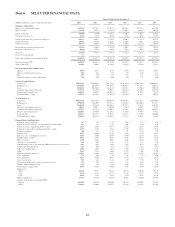

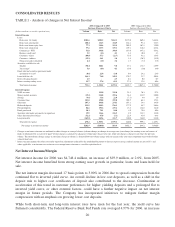

The following is a summary of the Company’s 2006 financial performance:

•Total revenue-FTE increased $407.3 million, or 5.2%, compared to 2005. Noninterest income

sources contributed $313.3 million, or 76.9% of the increase, led by strong mortgage production and

servicing income while net interest income-FTE contributed $93.9 million, or 23.1% of the increase.

18