SunTrust 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

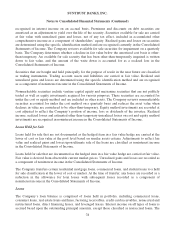

Notes to Consolidated Financial Statements (Continued)

Benefit Plans”, to the Consolidated Financial Statements. Effective January 1, 2006, the Company

adopted SFAS No. 123 (Revised) Share-Based Payment, (“SFAS No. 123(R)”), using the modified

prospective application method. The modified prospective application method was applied to new

awards, to any outstanding liability awards, and to awards modified, repurchased, or cancelled after

January 1, 2006. For all awards granted prior to January 1, 2006, compensation cost has been recognized

on the portion of awards for which service has been rendered. Additionally, rather than recognizing

forfeitures as they occur, beginning January 1, 2006, the Company began estimating the number of

awards for which it is probable that service will be rendered and adjusted compensation cost

accordingly. Estimated forfeitures are subsequently adjusted to reflect actual forfeitures.

Foreign Currency Transactions

Foreign denominated assets and liabilities resulting from foreign currency transactions are valued using

period end foreign exchange rates and the associated interest income or expense are valued using

approximate weighted average exchange rates for the period. The Company may elect to enter into

foreign currency derivatives to mitigate its exposure to changes in foreign exchange rates. The

derivative contracts are valued at fair value. Gains and losses resulting from such valuations are

included as noninterest income in the Consolidated Statements of Income.

Accounting Policies Recently Adopted and Pending Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 123(R). This

Statement replaces SFAS No. 123, “Accounting for Stock-Based Compensation,” and supersedes

Accounting Practice Bulletin (“APB”) Opinion No. 25, “Accounting for Stock Issued to Employees.”

SFAS No. 123(R) clarifies and expands the guidance of SFAS No. 123 in several areas, including

measuring fair value, classifying an award as equity or as a liability, accounting for non-substantive

vesting provisions, and accounting for forfeitures. Under the provisions of SFAS No. 123(R), the

alternative to use APB Opinion No. 25’s intrinsic value method of accounting that was provided in

SFAS No. 123, as originally issued, is eliminated, and entities are required to measure and record

compensation expense in share-based payment transactions at fair value, reduced by expected

forfeitures. In accordance with SFAS No. 123(R), the Company changed its policy of recognizing

forfeitures as they occur and began estimating the number of awards for which it is probable service will

be rendered. The estimate of forfeitures adjusts the initial recognition of compensation expense and the

estimated forfeitures are subsequently adjusted through compensation expense to reflect actual

forfeitures. In conjunction with the adoption of SFAS No. 123(R), the Company refined its

measurement of the expected stock price volatility calculation by using a daily average calculation. The

adoption of this standard did not have a material impact on the Company’s financial position or results

of operations.

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections - a

replacement of APB Opinion No. 20 and FASB Statement No. 3.” SFAS No. 154 changes the

requirements for reporting and accounting for a change in accounting principle. This statement requires

retrospective application to prior period financial statements for changes in accounting principle, unless

it is impracticable to determine either the period-specific effects or the cumulative effect of the change.

The provisions of APB Opinion No. 20, “Accounting Changes,” that relate to reporting the correction of

an error in previously issued financial statements and a change in accounting estimate are carried

forward in SFAS No. 154. SFAS No. 154 also carries forward the provisions of SFAS No. 3, “Reporting

83