SunTrust 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.First, a comment on the change in format of our Annual Report.

We have moved away from colorful photos, creative themes and

costly graphics, and we use a comprehensive regulatory report

to convey details of the year’s financial results.

This fresh approach reflects feedback from shareholders as well

as our own sense of efficiency. As we see it, spending extra

money on a glossy, paper-based annual report when so many

people prefer electronically delivered information simply is not

in our shareholders’ financial interest. If you would like to know

more about SunTrust strategies, performance, products or services,

please visit our Web site (suntrust.com) or contact us directly.

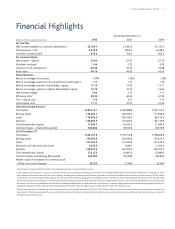

FINANCIAL HIGHLIGHTS

The interest rate environment presented a real challenge for the

U.S. banking industry in 2006. At SunTrust, as at other banks,

an inverted yield curve – the difference between short-term and

long-term interest rates – brought pressure to bear on our net

interest margin. This, in turn, meant less robust growth in overall

net income than we expected when the year began or that we

believe is indicative of our true longer-term earnings potential.

Margin pressures notwithstanding, the Company posted record

net income available to common shareholders for the year of

$2.1 billion, which was up 6 percent over the prior year. Diluted

earnings per common share were $5.82, also up 6 percent over

the prior year. Reflected in this performance were gains in most

major earnings components, including:

•Total revenue was $8.2 billion in 2006, up 5 percent

from the prior year.

•Net interest income was $4.7 billion, up 2 percent

from a year earlier.

•Noninterest income was $3.5 billion, up 10 percent

from 2005.

•Noninterest expense was $4.9 billion, up 4 percent

from a year ago.

•Average loans and consumer and commercial deposits grew,

respectively, 10 percent and 4 percent over a year ago.

In the credit quality arena, net charge-offs were 0.21 percent

of average loans, a level that is better than the Company’s

historical average.

Complete 2006 financial results, including each of the above

items, are discussed in considerable detail in the Form 10-K

which follows this letter. Included is a breakdown of the financial

performance of our primary lines of business.

In February 2007, the Board of Directors approved a 20 percent

increase in the quarterly dividend on SunTrust common stock,

a move consistent with the Company’s multi-year pattern of

annual dividend increases. The current indicated annual

dividend is now $2.92 per share.

2006 WAS NOT AN EASY YEAR FOR THE U.S. BANKING INDUSTRY. SUNTRUST, LIKE OTHER LARGE

BANKS, FELT THE IMPACT OF PRESSURES THAT CAME LARGELY FROM AN UNACCOMMODATING

INTEREST RATE ENVIRONMENT. THE GOOD NEWS IS THAT THE DISTINCTIVE STRENGTHS OF OUR

INSTITUTION—NOTABLY THE COMMITMENT OF OUR PEOPLE TO HELP OUR CLIENTS—PERMITTED

US TO GROW EARNINGS WHILE CONTINUING TO INVEST FOR FUTURE GROWTH. IN THIS LETTER,

WE WILL SHARE WITH YOU SOME PERSPECTIVES ON 2006. IMPORTANTLY, WE WILL ALSO TALK

ABOUT HOW WE ARE WORKING TO ENHANCE OUR FINANCIAL PERFORMANCE AS WE LOOK AHEAD.

To Our Shareholders