SunTrust 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

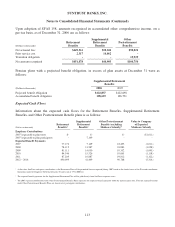

Notes to Consolidated Financial Statements (Continued)

Preferred Stock

On September 12, 2006, the Company issued depositary shares representing ownership interests in

5,000 shares of Perpetual Preferred Stock, Series A, no par value and $100,000 liquidation preference

per share (the “Series A Preferred Stock”). The Series A Preferred Stock has no stated maturity and will

not be subject to any sinking fund or other obligation of the Company. Dividends on the Series A

Preferred Stock, if declared, will accrue and be payable quarterly at a rate per annum equal to the greater

of three-month LIBOR plus 0.53 percent, or 4.00 percent. Dividends on the shares initially will be

cumulative. During the cumulative period, the Company will have an obligation to pay any unpaid

dividends. However, dividends on the shares will automatically become non-cumulative immediately

upon the effective date of an amendment to the Company’s articles of incorporation to eliminate the

requirement that the Company’s preferred stock dividend be cumulative, and such amendment will be

voted upon by the Company’s shareholders at their next annual meeting to be held on April 17, 2007.

During the non-cumulative dividend period, the Company will have no obligation to pay dividends that

were undeclared and unpaid during the cumulative dividend period.

Shares of the Series A Preferred Stock have priority over the Company’s common stock with regard to

the payment of dividends. As such, the Company may not pay dividends on or repurchase, redeem, or

otherwise acquire for consideration shares of its common stock unless dividends for the Series A

Preferred Stock have been declared for that period, and sufficient funds have been set aside to make

payment.

On or after September 15, 2011, the Series A Preferred Stock will be redeemable at the Company’s

option at a redemption price equal to $100,000 per share, plus any declared and unpaid dividends.

Except in certain limited circumstances, the Series A Preferred Stock does not have any voting rights.

The Company incurred $7.7 million of issuance costs paid to external parties in this transaction, which

were recorded as a reduction in net proceeds and charged to additional paid in capital.

On November 14, 2006, the Board declared a fourth quarter cash dividend totaling $1,545.78 per

preferred share which was paid on December 15, 2006 to shareholders of record at the close of business

on December 1, 2006.

Accelerated Share Repurchase Agreement

On October 24, 2006, the Company repurchased 9,926,589 shares of its common stock under an

Accelerated Share Repurchase agreement. The Company paid $870.7 million, net of settlement costs,

for the repurchased shares. This payment increased Treasury Stock by $771.8 million based on an

average share price of $77.75 per common share repurchased and decreased additional paid in capital

$98.9 million representing the difference between the payment and the market value of common shares

repurchased.

Under the terms of the agreement, the Company will not be required to make any additional payments to

the counterparty. However, the Company could receive additional shares under the agreement. The

number of additional shares received, if any, will depend upon the volume weighted average price of

SunTrust common stock over a period concluding on March 8, 2007 subject to a maximum 2,647,093

additional shares. If the Company receives additional shares, Treasury Stock will be further increased

103