SunTrust 2006 Annual Report Download - page 41

Download and view the complete annual report

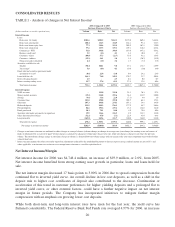

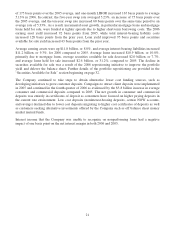

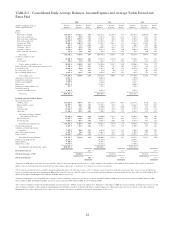

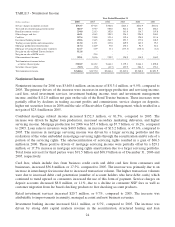

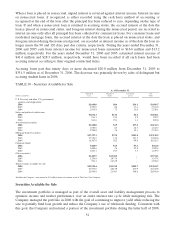

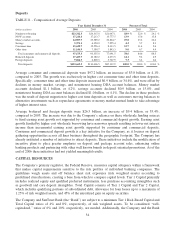

Please find page 41 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loans held for sale, which predominantly consists of warehoused mortgage loans, were $11.8 billion, a

decrease of $1.9 billion, or 13.9%, from December 31, 2005. The decrease was attributable to loan sales

exceeding the origination of loans held for sale due in part to the interest rate and housing market

environments in 2006.

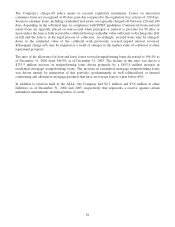

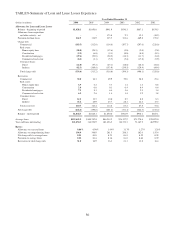

Allowance for Loan and Lease Losses

SunTrust continuously monitors the quality of its loan portfolio and maintains an allowance for loan and

lease losses (“ALLL”) sufficient to absorb probable losses inherent in its loan portfolio. The Company is

committed to the early recognition of problem loans and to an appropriate and adequate level of

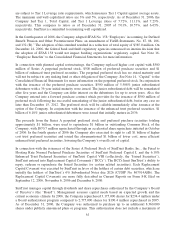

allowance. At year-end 2006, the Company’s total allowance was $1.0 billion, which represented 0.86%

of period-end loans.

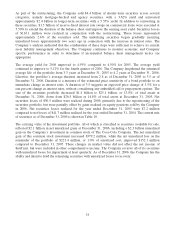

In addition to the review of credit quality through ongoing credit review processes, the Company

employs a variety of modeling and estimation tools for measuring credit risk that are used to construct

an appropriate ALLL. The Company’s allowance framework has three basic elements: a formula-based

component for pools of homogeneous loans; specific allowances for loans reviewed for individual

impairment; and an unallocated component that is based on other inherent risk factors and imprecision

associated with modeling and estimation processes. This framework enables the Company to better align

loss estimation practices with the different types of credit risk inherent in the loan portfolio.

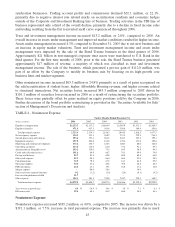

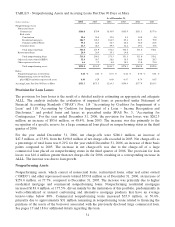

The first element — the general allowance for homogeneous loan pools — is determined by applying

allowance factors to pools of loans within the portfolio that have similar characteristics in terms of line

of business and product type. The general allowance factors are determined using a baseline factor that

is developed from an analysis of historical charge-off experience and expected losses. Expected losses

are based on estimated probabilities of default and losses given default derived from an internal risk

rating process. These baseline factors are developed and applied to the various loan pools. Adjustments

are made to the baseline factor for specific loan pools based on an assessment of internal and external

influences on credit quality that are not fully reflected in the historical loss or risk-rating data. These

influences may include elements such as changes in credit underwriting or recent observable asset

quality trends. Finally, the baseline factors are adjusted using a number of models which are intended to

compensate for internal and external portfolio influences that may not be captured in the adjusted

baseline factors. The Company continually evaluates its allowance methodology seeking to refine and

enhance this process as appropriate, and it is likely that the methodology will evolve over time. As of

December 31, 2006 and 2005, the general allowance calculations totaled $937.1 million and $929.3

million, respectively. The increase was due to loan growth and higher allowance factors associated with

residential mortgage products, partially offset by lower allowance factors associated with Corporate

Banking products.

The second element of the ALLL analysis involves the estimation of allowances specific to individual

impaired loans. In this process, specific allowances are established for nonaccruing commercial and

residential loans greater than $2 million based on a thorough analysis of the most probable sources of

repayment, including discounted future cash flows, liquidation of collateral, or the market value of the

loan itself. As of December 31, 2006 and 2005, the specific allowance related to impaired loans totaled

$17.4 million and $13.8 million, respectively.

The third element of the allowance is the unallocated reserve that addresses inherent losses that are not

otherwise evaluated in the first two elements. The qualitative factors of this third allowance element are

subjective and require a high degree of management judgment. These factors include the inherent

imprecision in mathematical models, recent economic uncertainty, losses incurred from recent events,

and lagging or incomplete data. As of December 31, 2006 and 2005, the allowance estimated in the third

element totaled $90.0 million and $85.0 million, respectively.

28