SunTrust 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$1 billion or 13,333,334 shares authorized by the Board in August of 2006. Under the August

authorization, the Company entered into an Accelerated Share Repurchase agreement and has already

repurchased 9,926,589 shares for $870.7 million, net of settlement costs. The Company could receive

additional shares under the agreement, dependent upon the volume weighted average price per share of

SunTrust common stock over a period concluding in March of 2007, subject to a maximum of 2,647,093

shares. The Company chose the Accelerated Share Repurchase agreement rather than repurchase shares

under its existing program because an open market repurchase would have taken considerably longer

subjecting the Company to potentially higher repurchase prices. Additionally, the Accelerated Share

Repurchase agreement provided market visibility of the Company’s intent to reduce its share base. The

Company declared and paid common dividends totaling $879.6 million in 2006, or $2.44 per common

share, on net income available to common shareholders of $2,109.7 million. The dividend payout ratio

was 41.7% for 2006 versus 40.0% for 2005.

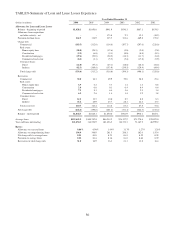

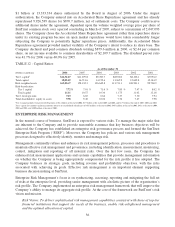

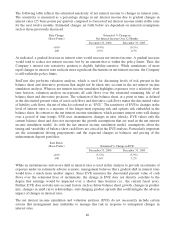

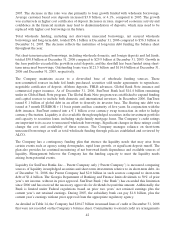

TABLE 12 - Capital Ratios

As of December 31

(Dollars in millions) 2006 2005 2004 2003 2002 2001

Tier 1 capital1$12,524.7 $11,079.8 $9,783.7 $8,930.0 $8,106.1 $7,994.2

Total capital 18,024,9 16,713.6 14,152.6 13,365.9 12,609.8 12,144.2

Risk-weighted assets 162,236.7 158,132.3 136,642.8 113,711.3 108,501.1 99,700.9

Risk-based ratios:

Tier 1 capital 7.72% 7.01 % 7.16 % 7.85 % 7.47 % 8.02 %

Total capital 11.11 10.57 10.36 11.75 11.62 12.18

Tier 1 leverage ratio 7.23 6.65 6.64 7.37 7.30 7.94

Total shareholders’ equity to assets 9.78 9.40 10.06 7.76 7.47 7.98

1Tier 1 capital includes trust preferred obligations of $2.4 billion at the end of 2006, $1.9 billion at the end of 2005 and 2004, and $1.7 billion at the end of 2003, 2002 and 2001.

Tier 1 capital also includes qualifying minority interests in consolidated subsidiaries of $455 million at the end of 2006, $467 million at the end of 2005, $451 at the end of 2004,

2003 and 2002, and $100 million at the end of 2001.

ENTERPRISE RISK MANAGEMENT

In the normal course of business, SunTrust is exposed to various risks. To manage the major risks that

are inherent to the Company and to provide reasonable assurance that key business objectives will be

achieved, the Company has established an enterprise risk governance process and formed the SunTrust

Enterprise Risk Program (“SERP”). Moreover, the Company has policies and various risk management

processes designed to effectively identify, monitor and manage risk.

Management continually refines and enhances its risk management policies, processes and procedures to

maintain effective risk management and governance, including identification, measurement, monitoring,

control, mitigation and reporting of all material risks. Over the last few years, the Company has

enhanced risk measurement applications and systems capabilities that provide management information

on whether the Company is being appropriately compensated for the risk profile it has adopted. The

Company balances its strategic goals, including revenue and profitability objectives, with the risks

associated with achieving its goals. Effective risk management is an important element supporting

business decision making at SunTrust.

Enterprise Risk Management’s focus is on synthesizing, assessing, reporting and mitigating the full set

of risks at the enterprise level, providing senior management with a holistic picture of the organization’s

risk profile. The Company implemented an enterprise risk management framework that will improve the

Company’s ability to manage its aggregate risk profile. At the core of the framework are SunTrust’s risk

vision and mission.

Risk Vision: To deliver sophisticated risk management capabilities consistent with those of top-tier

financial institutions that support the needs of the business, enable risk-enlightened management

and the optimal allocation of capital.

36