SunTrust 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

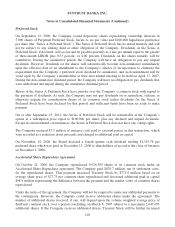

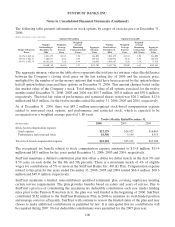

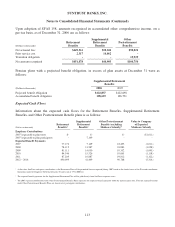

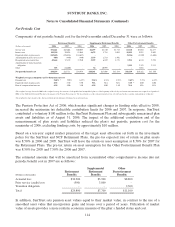

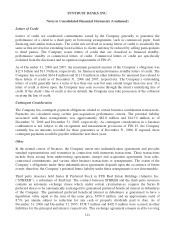

Upon adoption of SFAS 158, amounts recognized in accumulated other comprehensive income, on a

pre-tax basis, as of December 31, 2006 are as follows:

(Dollars in thousands)

Retirement

Benefits

Supplemental

Retirement

Benefits

Other

Postretirement

Benefits

Net actuarial loss $449,561 $30,041 $90,821

Prior service cost 2,317 14,862 -

Transition obligation - - 13,929

Net amount recognized $451,878 $44,903 $104,750

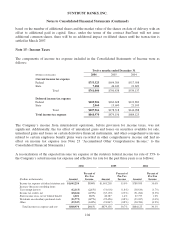

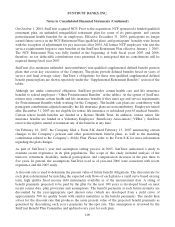

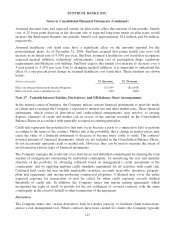

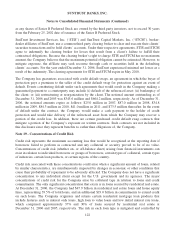

Pension plans with a projected benefit obligation, in excess of plan assets at December 31 were as

follows:

Supplemental Retirement

Benefits

(Dollars in thousands) 2006 2005

Projected benefit obligation $122,837 $122,698

Accumulated benefit obligation 108,619 106,791

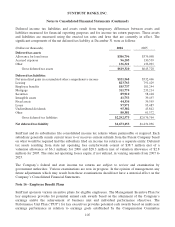

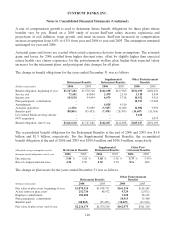

Expected Cash Flows

Information about the expected cash flows for the Retirement Benefits, Supplemental Retirement

Benefits, and Other Postretirement Benefit plans is as follows:

(Dollars in thousands)

Retirement

Benefits1

Supplemental

Retirement

Benefits2

Other Postretirement

Benefits (excluding

Medicare Subsidy)3

Value to Company

of Expected

Medicare Subsidy

Employer Contributions

2007 (expected) to plan trusts $- $- $- ($1,011)

2007 (expected) to plan participants - 7,149 - -

Expected Benefit Payments

2007 77,172 7,149 18,493 (1,011)

2008 78,112 13,587 18,883 (1,058)

2009 81,111 14,030 19,332 (1,095)

2010 84,346 15,526 19,665 (1,118)

2011 87,209 10,887 19,812 (1,122)

2012 – 2016 490,099 41,449 90,768 (5,314)

1At this time, SunTrust anticipates contributions to the Retirement Plan will be permitted (but not required) during 2007 based on the funded status of the Plan and contribution

limitations under the Employee Retirement Income Security Act of 1974 (ERISA).

2The expected benefit payments for the Supplemental Retirement Plan will be paid directly from SunTrust corporate assets.

3The 2007 expected contribution for the Other Postretirement Benefits Plans represents the expected benefit payments under the medical plans only. Note that expected benefits

under Other Postretirement Benefits Plans are shown net of participant contributions.

113