SunTrust 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

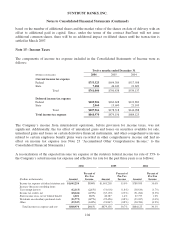

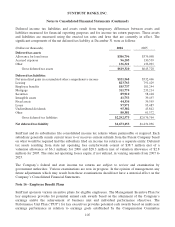

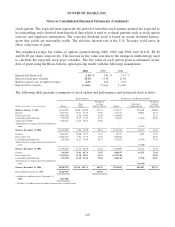

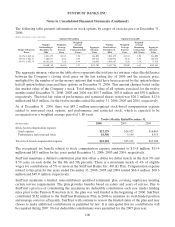

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

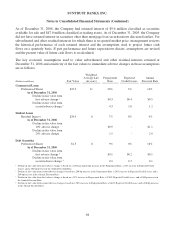

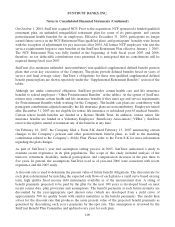

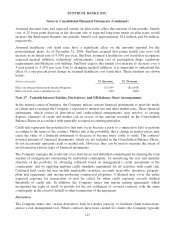

The following table presents information on stock options by ranges of exercise price at December 31,

2006:

(Dollars in thousands except per share data)

Options Outstanding Options Exercisable

Range of Exercise

Prices

Number

Outstanding at

December 31,

2006

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual Life

(Years)

Aggregate

Intrinsic

Value

Number

Exercisable at

December 31,

2006

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life (Years)

Aggregate

Intrinsic

Value

$14.56 to $49.46 1,081,459 $41.83 3.98 $46,092 1,081,459 $41.83 3.98 $46,092

$49.75 to $64.57 7,406,932 56.42 4.98 207,632 7,406,932 56.42 4.98 207,632

$64.73 to $83.74 10,192,319 72.58 6.44 120,983 2,999,367 71.89 3.18 37,658

18,680,710 $64.39 5.72 $374,707 11,487,758 $59.09 4.42 $291,382

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference

between the Company’s closing stock price on the last trading day of 2006 and the exercise price,

multiplied by the number of in-the-money options) that would have been received by the option holders

had all option holders exercised their options on December 31, 2006. This amount changes based on the

fair market value of the Company’s stock. Total intrinsic value of all options exercised for the twelve

months ended December 31, 2006, 2005 and 2004 was $85.7 million, $83.0 million and $50.6 million,

respectively. The total fair value of performance and restricted shares vested was $26.2 million, $13.6

million and $4.8 million, for the twelve months ended December 31, 2006, 2005 and 2004, respectively.

As of December 31, 2006, there was $83.2 million unrecognized stock-based compensation expense

related to nonvested stock options, and performance and restricted stock, which is expected to be

recognized over a weighted average period of 1.80 years.

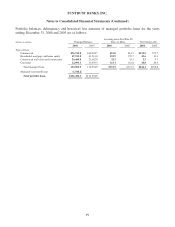

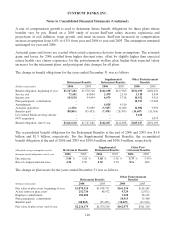

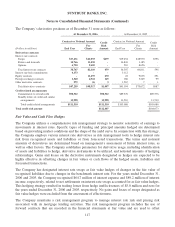

Twelve Months Ended December 31,

(In thousands) 2006 2005 2004

Stock-based compensation expense:

Stock options $23,329 $26,022 $16,865

Performance and restricted stock 18,340 9,190 8,515

Total stock-based compensation expense $41,669 $35,212 $25,380

The recognized tax benefit related to stock compensation expense amounted to $15.8 million, $13.4

million and $8.9 million for the years ended December 31, 2006, 2005 and 2004, respectively.

SunTrust maintains a defined contribution plan that offers a dollar for dollar match on the first 3% and

$.50 cents on each dollar for the 4th and 5th percents. There is a maximum match of 4% of eligible

wages for contributions of 5% or more in the SunTrust Banks, Inc. 401(k) Plan. Compensation expense

related to this plan for the years ended December 31, 2006, 2005 and 2004 totaled $66.4 million, $60.6

million and $49.0 million, respectively.

SunTrust maintains a funded, noncontributory qualified retirement plan covering employees meeting

certain service requirements. The plan provides benefits based on salary and years of service. Due to

SunTrust’s practice of contributing the maximum tax deductible contribution each year (under funding

rules prior to the Pension Protection Act), the plan was well funded at the beginning of 2006. SunTrust

contributed $182 million to the SunTrust Retirement Plan in 2006 to maintain its well-funded position

and manage costs tax-efficiently. SunTrust will continue to review the funded status of the plan and may

choose to make additional contributions as permitted by law. It is anticipated that no contributions will

be required during 2007. No tax deductible contributions were permitted for the 2005 plan year.

108