SunTrust 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

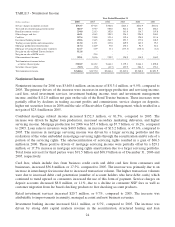

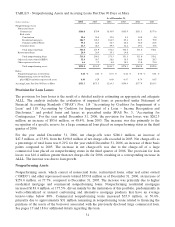

When a loan is placed on nonaccrual, unpaid interest is reversed against interest income. Interest income

on nonaccrual loans, if recognized, is either recorded using the cash basis method of accounting or

recognized at the end of the loan after the principal has been reduced to zero, depending on the type of

loan. If and when a nonaccrual loan is returned to accruing status, the accrued interest at the date the

loan is placed on nonaccrual status, and foregone interest during the nonaccrual period, are recorded as

interest income only after all principal has been collected for commercial loans. For consumer loans and

residential mortgage loans, the accrued interest at the date the loan is placed on nonaccrual status, and

foregone interest during the nonaccrual period, are recorded as interest income as of the date the loan no

longer meets the 90 and 120 days past due criteria, respectively. During the years ended December 31,

2006 and 2005 cash basis interest income for nonaccrual loans amounted to $16.6 million and $13.2

million, respectively. For the years ended December 31, 2006 and 2005, estimated interest income of

$41.6 million and $28.3 million, respectively, would have been recorded if all such loans had been

accruing interest according to their original contractual terms.

Accruing loans past due ninety days or more decreased $20.0 million from December 31, 2005 to

$351.5 million as of December 31, 2006. The decrease was primarily driven by sales of delinquent but

accruing student loans in 2006.

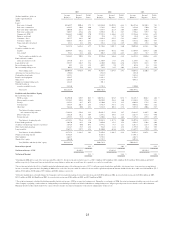

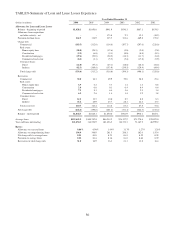

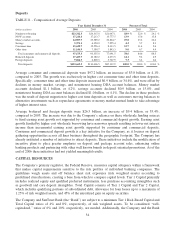

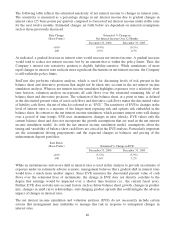

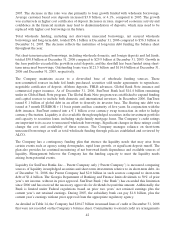

TABLE 10 - Securities Available for Sale

As of December 31

(Dollars in millions)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and other U.S. government

agencies and corporations

2006 $1,608.0 $8.6 $16.1 $1,600.5

2005 2,593.8 0.6 47.4 2,547.0

2004 2,543.9 7.2 13.0 2,538.1

States and political subdivisions

2006 $1,032.3 $13.4 $4.6 $1,041.1

2005 914.1 15.5 3.9 925.7

2004 841.6 25.1 1.1 865.6

Asset-backed securities

2006 $1,128.0 $1.9 $17.6 $1,112.3

2005 1,630.8 8.2 26.3 1,612.7

2004 2,590.0 7.6 19.1 2,578.5

Mortgage-backed securities

2006 $17,337.3 $37.4 $243.8 $17,130.9

2005 17,354.5 11.6 343.5 17,022.6

2004 18,367.0 58.2 99.9 18,325.3

Corporate bonds

2006 $468.9 $1.5 $7.6 $462.8

2005 1,090.6 2.6 22.8 1,070.4

2004 1,667.1 19.7 7.5 1,679.3

Other securities1

2006 $1,423.9 $2,330.2 - $3,754.1

2005 1,370.0 1,977.4 - 3,347.4

2004 921.3 2,032.9 - 2,954.2

Total securities available for sale

2006 $22,998.4 $2,393.0 $289.7 $25,101.7

2005 24,953.8 2,015.9 443.9 26,525.8

2004 26,930.9 2,150.7 140.6 28,941.0

1Includes the Company’s investment in 48.2 million shares of common stock of The Coca-Cola Company.

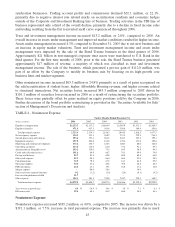

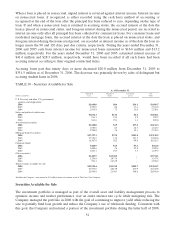

Securities Available for Sale

The investment portfolio is managed as part of the overall asset and liability management process to

optimize income and market performance over an entire interest rate cycle while mitigating risk. The

Company managed the portfolio in 2006 with the goal of continuing to improve yield while reducing the

size to partially fund loan growth and reduce the Company’s use of wholesale funding. Consistent with

this goal, the Company restructured a portion of the investment portfolio during the latter half of 2006.

32