SunTrust 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

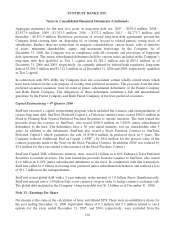

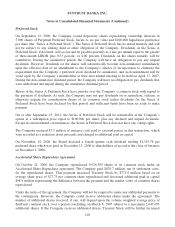

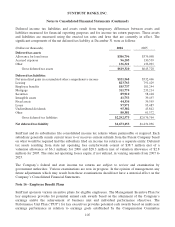

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

based on the number of additional shares and the market value of the shares on date of delivery with an

offset to additional paid in capital. Since, under the terms of the contract SunTrust will not issue

additional common shares, there will be no additional impact on diluted shares until the transaction is

settled in March 2007.

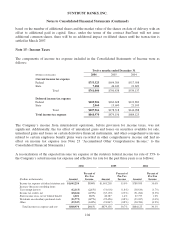

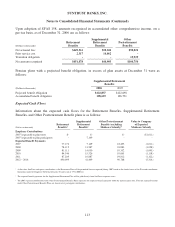

Note 15 - Income Taxes

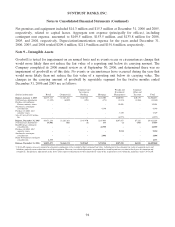

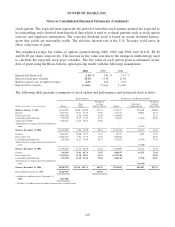

The components of income tax expense included in the Consolidated Statements of Income were as

follows:

Twelve months ended December 31

(Dollars in thousands) 2006 2005 2004

Current income tax expense

Federal $753,523 $654,389 $517,508

State 7,481 46,449 21,629

Total $761,004 $700,838 $539,137

Deferred income tax expense

Federal $105,906 $162,628 $123,883

State 2,060 15,690 21,105

Total $107,966 $178,318 $144,988

Total income tax expense $868,970 $879,156 $684,125

The Company’s income from international operations, before provision for income taxes, was not

significant. Additionally, the tax effect of unrealized gains and losses on securities available for sale,

unrealized gains and losses on certain derivative financial instruments, and other comprehensive income

related to certain employee benefit plans were recorded in other comprehensive income and had no

effect on income tax expense (see Note 23 “Accumulated Other Comprehensive Income,” to the

Consolidated Financial Statements.)

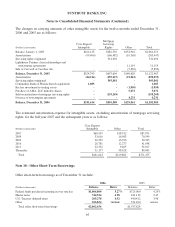

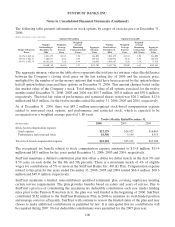

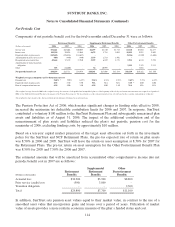

A reconciliation of the expected income tax expense at the statutory federal income tax rate of 35% to

the Company’s actual income tax expense and effective tax rate for the past three years is as follows:

2006 2005 2004

(Dollars in thousands) Amount

Percent of

Pre-Tax

Income Amount

Percent of

Pre-Tax

Income Amount

Percent of

Pre-Tax

Income

Income tax expense at federal statutory rate $1,045,254 35.0% $1,003,238 35.0% $789,959 35.0%

Increase (decrease) resulting from:

Tax-exempt interest (62,113) (2.1%) (51,016) (1.8%) (38,610) (1.7%)

Income tax credits, net (68,646) (2.3%) (67,130) (2.3%) (51,264) (2.3%)

State income taxes, net of federal benefit 6,201 0.2% 40,387 1.4% 27,777 1.2%

Dividends on subsidiary preferred stock (21,779) (0.7%) (22,456) (0.8%) (23,037) (1.0%)

Other (29,947) (1.0%) (23,867) (0.8%) (20,700) (0.9%)

Total income tax expense and rate $868,970 29.1% $879,156 30.7% $684,125 30.3%

104