SunTrust 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

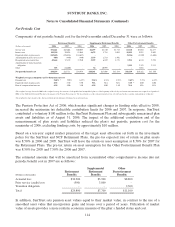

Deferred income tax liabilities and assets result from temporary differences between assets and

liabilities measured for financial reporting purposes and for income tax return purposes. These assets

and liabilities are measured using the enacted tax rates and laws that are currently in effect. The

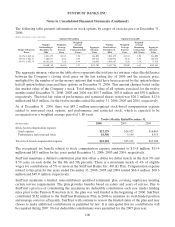

significant components of the net deferred tax liability at December 31 were as follows:

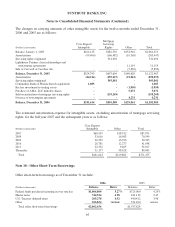

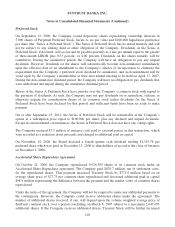

(Dollars in thousands) 2006 2005

Deferred tax assets

Allowance for loan losses $386,796 $379,098

Accrued expenses 96,203 130,539

Other 136,321 136,091

Gross deferred tax assets $619,320 $645,728

Deferred tax liabilities

Net unrealized gains in accumulated other comprehensive income $521,568 $532,466

Leasing 823,763 791,429

Employee benefits 185,737 181,244

Mortgage 311,774 233,214

Securities 89,910 58,418

Intangible assets 41,753 39,497

Fixed assets 44,334 39,595

Loans 97,971 95,487

Undistributed dividends 95,382 43,842

Other 80,381 61,572

Gross deferred tax liabilities $2,292,573 $2,076,764

Net deferred tax liability $1,673,253 $1,431,036

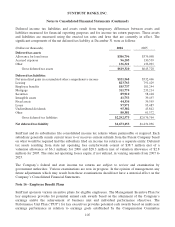

SunTrust and its subsidiaries file consolidated income tax returns where permissible or required. Each

subsidiary generally remits current taxes to or receives current refunds from the Parent Company based

on what would be required had the subsidiary filed an income tax return as a separate entity. Deferred

tax assets resulting from state net operating loss carryforwards consist of $38.7 million (net of a

valuation allowance of $6.1 million) for 2006 and $28.3 million (net of valuation allowance of $2.8

million) for 2005. The state net operating losses expire, if not utilized, in varying amounts from 2007 to

2023.

The Company’s federal and state income tax returns are subject to review and examination by

government authorities. Various examinations are now in progress. In the opinion of management, any

future adjustments which may result from these examinations should not have a material effect on the

Company’s Consolidated Financial Statements.

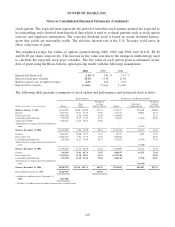

Note 16 - Employee Benefit Plans

SunTrust sponsors various incentive plans for eligible employees. The Management Incentive Plan for

key employees provides for potential annual cash awards based on the attainment of the Company’s

earnings and/or the achievement of business unit and individual performance objectives. The

Performance Unit Plan (“PUP”) for key executives provides potential cash awards based on multi-year

earnings performance in relation to earnings goals established by the Compensation Committee

105